Tabhairt isteach

Cén fáth a bhfuil tábhacht ag an Eoraip le Xiaomi

Ní hamháin gur margadh thar lear eile í an Eoraip do Xiaomi - is é an scrúdú deiridh é. Más í an Áise an áit a dtógtar scála agus na margaí atá ag teacht chun cinn áit a bhfásann toirt, is í an Eoraip an áit a ndéantar fíorthástáil ar bhrandaí. Tomhaltóirí aibí, rialacháin dochta, tionchar iompróir láidir, agus dílseacht do bhrandaí atá fréamhaithe go domhain, tá an Eoraip ar cheann de na láithreacha fón cliste is deacra ar domhan.

Ó Challenger go dtí an Ardleibhéal Iomaitheoir

I 2025, Ní hamháin gur léirigh Xiaomi - rinne sé torann. Trí Apple a scoitheadh i sciar den mhargadh le linn R2, Thug Xiaomi le fios nach bhfuil sé sásta a bheith mar an “rogha saor.” Tá sé ag iarraidh suíochán ag an mbord préimhe, fiú má tá an chathaoir sin fós beagán wobbly.

Achoimre Fheidhmeach

Briseadh Stairiúil i R2 2025

An dara ráithe de 2025 marcáilte cloch mhíle. Ghlac Xiaomi thart 23% den mhargadh smartphone Eorpach, ag dul thar Apple don chéad uair sa stair agus ag fáil an dara háit taobh thiar de Samsung. Ní raibh sé seo ina ráithe ádh - bhí sé mar thoradh ar bhlianta de bhunobair.

Cad a chiallaíonn an t-athrú seo i ndáiríre

Léiríonn an éacht seo níos mó ná líon na lastais. Léiríonn sé go bhfuil brandaí na Síne, faoi stiúir Xiaomi, ag aistriú ó leathnú ionsaitheach go hiomaíocht luach-tiomáinte. An cheist mhór anois: an féidir le Xiaomi móiminteam a iompú isteach i gcothromas branda fadtéarmach?

Forbhreathnú ar an Margadh Fón Cliste Eorpach

Aibíocht agus Sáithiú Margaidh

Tá margadh na bhfón cliste san Eoraip cosúil le fobhealach plódaithe le linn na haimsire ráithí - tá gach duine istigh cheana féin. Ní thagann an fás ó úsáideoirí nua ach ó dhaoine a chur ina luí chun brandaí a athrú nó a uasghrádú níos tapúla.

Treochtaí Iompraíochta Tomhaltóirí (2025–2026)

Tá tomhaltóirí Eorpacha pragmatach. Chuir boilsciú agus éiginnteacht eacnamaíoch ceannaitheoirí ar an eolas faoi phraghsanna, ach ní ar chostas cáilíochta.

Íogaireacht Buiséid vs. Dílseacht Branda

Anseo luíonn an paradacsa: tá margaí níos fearr ag teastáil ó thomhaltóirí, fós ceangailte go mothúchánach le Apple agus Samsung. Is é dúshlán Xiaomi nósanna a bhriseadh gan muinín a bhriseadh.

Feidhmíocht Margaidh Xiaomi san Eoraip

Míniú ar Fhás Sciar Mhargaidh

Le fás bliain ar bhliain de thart 11%, Ba é Xiaomi an t-aon bhranda as na trí cinn a d’fhás i R2 2025. Dhiúltaigh Samsung agus Apple araon, ag oscailt fuinneog annamh deiseanna.

Sonraí Loingsiú vs. Sonraí Úsáideora Gníomhacha

Léiríonn tuarascálacha bunaithe ar loingsiú Xiaomi mar powerhouse. Cén dóigh faoin spéir a ...?, Insíonn sonraí bunaithe ar úsáid scéal níos coimeádaí.

An Bhearna Sonraí a Thuiscint

Tugann an bhearna seo le tuiscint go ndíolann Xiaomi go leor fóin - ach is feistí iontrála nó lár-raoin go leor. Tá láithreacht an mhargaidh láidir, ach tá mindshare préimhe chun deiridh fós.

Anailís Iomaíoch Tírdhreacha

Seasamh cosanta Samsung

Tá Samsung fós ina cheannaire ar an Eoraip a bhuíochas dá phunann leathan agus dá chaidrimh iompróra. Ach tá tuirse ag teacht ar lastais atá ag dul i laghad.

Daingean Préimh Apple

Seans gur shleamhnaigh Apple go dtí an tríú háit, ach tá a greim ar an deighleog ard-deireadh fós ironclad. Is é dílseacht a arm rúnda.

Iomaitheoirí ag Teacht Chun Cinn: Motorola agus realme

Léiríonn meath Motorola agus ardú realme go bhfuil an catha lár-réimse i bhfad ó socraithe. Ní féidir le Xiaomi a bheith bogásach.

Straitéis Débhranda: Xiaomi + Redmi

Redmi mar an Inneall Toirt

Éiríonn le Redmi áit a bhfuil sparán daingean. Seachadann sé specs a bhraitheann cosúil le mhargadh, go háirithe le linn cor chun donais eacnamaíoch.

Xiaomi Brand mar an Tógálaí Íomhá

Cé go dtugann Redmi trácht, Tá sé i gceist go dtógfaidh príomh-áiteanna branda Xiaomi gradam.

Deighilt shoiléir nó Mearbhall Branda?

Uaireanta blurs an líne idir Redmi agus Xiaomi. Tá idirdhealú níos soiléire riachtanach chun féin-cannibalization a sheachaint.

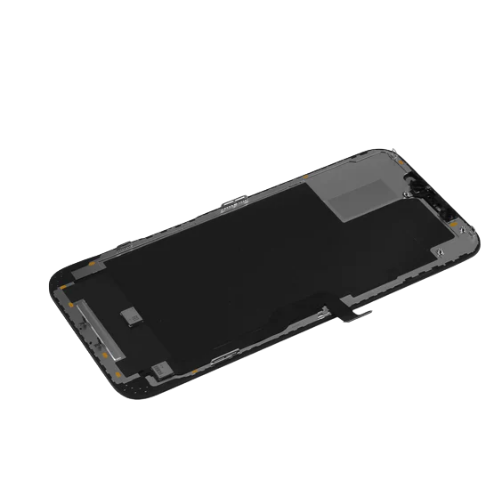

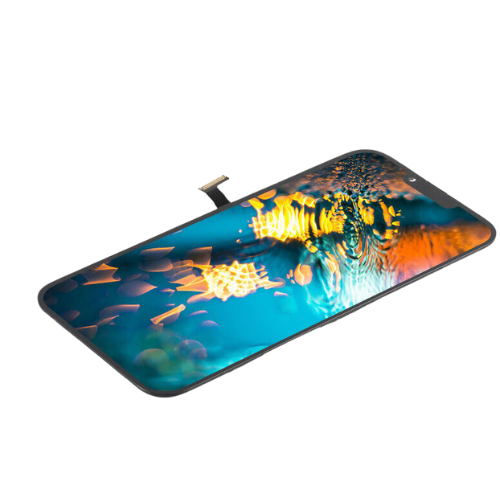

Straitéis Táirge agus Optamú Punainne

Sraith Suaitheanta agus Fillteáin

Is taispeántais teicneolaíochta iad sraith dhigiteach Xiaomi agus fóin infhillte. Cruthaíonn siad gur féidir le Xiaomi a bheith nuálaíoch, ní hamháin dul san iomaíocht ar phraghas.

Forlámhas Lár-Raon

Is é seo crios chompord Xiaomi. Sonraíochtaí láidre, praghsáil ionsaitheach, agus cuireann timthriallta athnuachana tapa na hiomaitheoirí ar bharraicíní.

Straitéis Praghsála san Eoraip boilscithe

Feidhmíonn praghsáil sholúbtha Xiaomi mar mhaolaitheoirí turrainge, ag cuidiú leis bumps eacnamaíoch a nascleanúint níos fearr ná brandaí préimhe dochta.

Nuálaíocht agus Logánú Cainéal

Comhpháirtíocht Straitéiseach le AliExpress

Is athrú cluiche é an comhoibriú le AliExpress. Ní bhaineann sé seo ach le fón a dhíol - baineann sé le bheith ina húinéir ar an gcaidreamh custaiméara.

Cainéil Oibreora vs. Díreach-go-Tomhaltóir

Cé go dtugann iompróirí scála, cuireann bealaí díreacha smacht ar fáil. Tá Xiaomi ag cothromú an dá rud go ciallmhar.

Eispéireas Branda Logánta a Thógáil

Ábhar logánta, loighistic, agus tá tacaíocht iar-díolacháin ag casadh Xiaomi ó bhranda eachtrach in ainm eolach.

Buntáiste Éiceachóras “Duine-Gluaisteán-Tí”.

Fóin chliste mar an Mol Rialaithe

I saol Xiaomi, Is é an fón an inchinn, ní an comhlacht. Ceanglaíonn gach rud ar ais leis.

Fás AIoT san Eoraip

Le méadú ar ioncam AIoT 60%, Tá Xiaomi á neadú go ciúin i dtithe Eorpacha.

Éifeacht Glasáil Isteach ar an Éiceachóras

Nuair a cheannaíonn úsáideoirí isteach san éiceachóras, mothaíonn fágáil cosúil le bogadh tithe - is féidir, ach pianmhar.

Dearcadh Branda agus an Aincheist Préimh

An Lipéad “Luach ar Airgead”.

Thóg an lipéad seo Xiaomi - ach féadfaidh sé é a chur i mboscaí freisin.

An féidir le Xiaomi a bheith i ndáiríre Préimh?

Ní crua-earraí amháin í an phréimh. Is scéalaíocht é, comhsheasmhacht, agus nasc mothúchánach.

Ceachtanna ó Apple agus Samsung

Díolann an dá bhranda mothúcháin an oiread agus is gnéithe. Tá Xiaomi ag foghlaim - ach is maratón é, ní sprint.

Táscairí Airgeadais agus Dúshláin ASP

Mínithe ASP Meath

Tharraing sciar níos airde de shamhlacha buiséid síos meánphraghsanna díola i R2 2025.

Scála vs. Brabúsacht

Ní chiallaíonn níos mó aonad i gcónaí níos mó brabúis. Caithfidh Xiaomi uaillmhian a chothromú le corrlaigh.

An bhfuil Fás Inbhuanaithe?

Is féidir - ach amháin má fhaigheann feistí préimhe fíor-tharraingt.

Príomhrioscaí agus Dúshláin Romhainn

Comórtas Tréanaithe

Tá cogaí praghsanna brúidiúil, agus tá timthriallta nuálaíochta ag giorrú.

Rioscaí Geilleagracha agus Geopolitical

boilsciú, polasaithe trádála, agus cuireann teannais gheopholaitiúla sraitheanna éiginnteachta leis.

Éiginnteacht Rialála agus Trádála

Is féidir le costais chomhlíonta agus athruithe beartais na buntáistí a chreimeadh go tapa.

Ionchas Straitéiseach do 2025-2026

Ag dul isteach sa 200 Club milliún

Tá sé mar aidhm ag Xiaomi a bheith páirteach i Samsung agus Apple mar dhíoltóir bliantúil 200-milliún-aonad.

An Eoraip mar Láthair Catha Fadtéarmach

Níl rath ar an Eoraip roghnach - tá sé fíorasach.

Moltaí Straitéiseacha

Tosaíochtaí Tógála Branda

Dírigh ar mhargaíocht shuaitheanta ar scéalaíocht, ní specs.

Comhtháthú Táirge agus Éiceachórais

Cuir na fóin chliste le chéile le táirgí AIoT chun réitigh stíl mhaireachtála a chruthú.

Optamú Cainéal agus Miondíola

Déan siopaí as líne a thiontú ina lárionaid taithí thumoideachais éiceachórais.

Deireadh

Ó Briseadh Trína go Briseadh Amach

Tá ardú Xiaomi san Eoraip go hiontach, ach tá an fíordhúshlán romhainn. Is féidir sciar den mhargadh a bhuachan le praghsáil agus le luas; glacann luach branda foighne agus creideamh. Ní bhaineann an chéad chaibidil eile le dul sa tóir ar Apple - baineann sé le bheith do-thuigthe Xiaomi. Má éiríonn leis, ní bua corparáideach amháin a bheidh anseo, ach treoirphlean do bhrandaí Síneacha a bhfuil sé mar aidhm acu domhanda.

Ceisteanna Coitianta

1. Cén fáth ar sháraigh Xiaomi Apple san Eoraip i 2025?

De bharr díolacháin lár-réimse láidir, praghsáil solúbtha, agus laghdaítear lastas iomaitheoirí.

2. An meastar gur branda préimhe san Eoraip é Xiaomi?

Níl sé go hiomlán fós. Tá meas ar luach, ach tá dearcadh préimhe ag teacht chun cinn fós.

3. Cén ról atá ag Redmi i straitéis Xiaomi?

Tiomáineann Redmi toirt agus dul i bhfód sa mhargadh, go háirithe i measc ceannaitheoirí atá feasach ar bhuiséad.

4. Cé chomh tábhachtach is atá éiceachóras AIoT do Xiaomi?

Is príomhdhifreálaí é a mhéadaíonn dílseacht úsáideora agus luach fadtéarmach.

5. An féidir le Xiaomi a fhás a choinneáil tríd 2026?

Tá, ach amháin má chothromaíonn sé scála go rathúil le tógáil branda préimhe.