The reshaping of the global display industry

В 2025, the global display landscape has officially been redrawn. For the first time in history, China holds 70% of global display panel production, according to Omdia’s latest report. This means that seven out of every ten display panels used worldwide come from Chinese factories — a monumental shift that cements China’s position as the global display powerhouse.

What does “70% market share” mean for global supply chains?

This dominance is not just about numbers — it represents a massive realignment in global manufacturing and technology influence. From smartphones to TVs, automotive screens to gaming monitors, China’s display industry now forms the backbone of the world’s visual technology supply chain.

Global Display Industry Landscape 2025

China’s massive production advantage

China’s display output in 2024 reached an estimated ¥1.3 trillion, capturing over half of the global display market. Two core technologies — ЖК -дисплей (56.25%) и Олинг (14.51%) — dominate production, while export area share exceeds 74% worldwide.

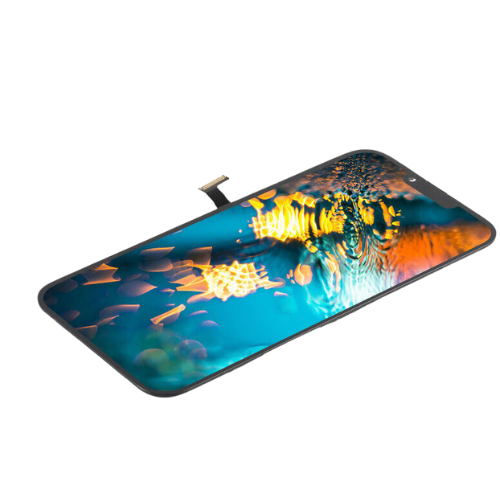

Smartphone display dominance

According to TrendForce, Chinese panel makers captured 68.8% of the smartphone display market in 2024, and are expected to surpass 70% в 2025. BOE leads the pack with 610 million smartphone panel shipments projected this year.

TV panel leadership and shipment statistics

In the LCD TV panel segment, China’s presence is equally strong. In Q1 2025, global large-size TV panel shipments reached 63 миллион единиц, with BOE holding 25.9%, CSOT 20.2%, and HKC 14.4%.

Market size and export strength

China’s vast manufacturing scale allows it to dominate exports as well — holding над 74% of the world’s display export area, reaffirming its grip on global supply.

The Rise of Chinese Display Manufacturers

BOE – The industry leader

BOE Technology Group has become a symbol of China’s industrial strength. In H1 2025, BOE reported ¥101.28 billion in revenue, an 8.45% year-over-year increase, и ¥3.247 billion in net profit, up 42.15% from the previous year.

Global shipment leadership across devices

BOE maintains global leadership across five key application areas — smartphones, таблетки, ноутбуки, monitors, and TVs — securing the #1 position worldwide in overall display shipments.

The OLED revolution led by BOE

OLED is the new growth engine for BOE. In H1 2025, OLED shipments exceeded 71 миллион единиц, growing 7.5% year-over-year — outpacing the global average.

8.6-generation AMOLED production line

BOE’s 8.6G AMOLED production line entered early equipment installation in May 2025 — four months ahead of schedule. Once operational by the end of 2026, it will allow BOE to compete head-on with Samsung and LG in the high-end OLED segment.

The growth of CSOT and Tianma

TCL CSOT and Tianma Microelectronics are also on the rise. CSOT’s smartphone panel shipments are forecasted to reach 192 миллионов единиц в 2025, while Tianma maintains around 188 миллион единиц, supported by rising AMOLED demand.

The Dual-Track Strategy: LCD and OLED Coexistence

How China keeps LCD alive in a new era

While OLED is the future, LCD remains the foundation. Chinese firms, leveraging economies of scale and technological refinement, dominate LCD production with a 64% share in 2024, expected to reach 69% в 2025.

BOE’s chairman, Chen Yanshun, noted that LCD has entered a “low-volatility growth phase”, remaining a key pillar of display technology for the next decade.

The OLED sprint for global recognition

Тем временем, China’s OLED momentum continues to surge. 2024 saw a 27% increase in AMOLED smartphone panel shipments, with a projected 5.2% growth в 2025. Банк Англии, Вижнокс, and Tianma have now entered Apple’s supply chain, proving global validation for Chinese OLED technology.

К 2024, Chinese OLED manufacturers held 46% of the market, closing in on South Korea’s 54%. In flexible OLED, China’s share already превзошел 57%, marking a historic shift in industry leadership.

Emerging Applications Driving New Growth Curves

Automotive displays: China’s next frontier

With smartphones nearing saturation, Chinese panel makers are targeting new growth curves — and automotive displays top the list. В 2024, global automotive display shipments hit 232 миллион единиц, up 6.3% year-on-year.

BOE leads this segment with 17.6% доля рынка, supplying brands like Zeekr, Changan, Chery, and Dongfeng. It also co-developed a 30-inch dual-screen for XPeng’s G9 model and a 10.25-inch instrument display for the G6.

Tianma’s automotive expansion

Tianma ranks second with 36.9 million shipments, up 25% year-on-year, supplying BYD, BMW, Ford, and Honda across multiple display sizes.

Gaming and esports displays: The next battleground

Esports displays are another booming frontier. 2024 saw 32.4 million LCD gaming monitors shipped globally, up 12% from the year before. The success of Black Myth: Wukong in late 2024 further boosted China’s domestic demand.

At COMPUTEX 2025, ASUS and MSI unveiled 27-inch 500Hz QD-OLED monitors, signaling a new high-performance standard. ASUS’s OLED display demand is expected to double to over 500,000 units in 2025.

The Challenges Ahead

Bottlenecks in OLED materials and equipment

Despite the success, challenges remain — particularly in OLED’s core materials and manufacturing equipment. China still relies heavily on imports for organic light-emitting materials и fine metal masks (FMM), dominated by Japan’s Idemitsu Kosan and the U.S.’s UDC.

Weaknesses in upstream–downstream collaboration

According to CINNO Research, domestic suppliers cover only 39% of OLED equipment processes, with key areas like evaporation and exposure tools having less than 20% localization. Japan’s Tokki, Canon, и Nikon still dominate these critical steps.

This results in slow adoption cycles — sometimes taking two years from verification to mass production — hindering upstream innovation and returns on R&Дюймовый.

The Profitability Dilemma

While market share is growing, profitability remains thin. OLED manufacturing requires high R&Дюймовый, long cycles, and heavy capital investment, leading to sustained financial pressure.

Вижнокс, China’s second-largest AMOLED producer, exemplifies this paradox — rapid market expansion but persistent losses. От 2021 к 2024, it recorded four consecutive years of net losses, totaling nearly ¥10 billion.

The Road to Global Leadership

Ten years ago, China’s display industry was still catching up. Сегодня, it’s setting the global pace. With BOE, ТКЛ CSOT, and Tianma among the world’s top five OLED suppliers, “Made in China” has evolved from follower to innovator.

The early equipment move-ins for 8.6G OLED lines and the rise of glass-based encapsulation show how fast the ecosystem is advancing. China’s display industry is not only competing — it’s leading.

Заключение: The Dawn of a New Era

By capturing 70% of global display production, China has rewritten the rules of the game. From LCD to OLED, from smartphones to cars, its technology, scale, and innovation are now shaping how the world sees its digital future.

As new frontiers like flexible displays, microLED, and automotive panels emerge, China is well-positioned to continue leading — not just in production, but in defining the next chapter of global display innovation.

Часто задаваемые вопросы

1. Why does China produce 70% of the world’s display panels?

Because of its unmatched scale, strong government support, advanced manufacturing capabilities, and continuous investment in R&D and OLED technology.

2. Who are China’s top display manufacturers in 2025?

The leading companies include BOE Technology Group, ТКЛ CSOT, Тианма Микроэлектроника, Вижнокс, и HKC.

3. What technologies are driving China’s display industry?

Primarily ЖК -дисплей и Олинг, with rapid growth in Амоль, Мини светодиод, и flexible OLED for smartphones and automotive applications.

4. What challenges does China face in OLED production?

Dependence on imported materials and equipment, low localization rates, and a slow innovation adoption cycle across the supply chain.

5. How will the global display market evolve after 2025?

Expect faster OLED adoption, microLED breakthroughs, and China solidifying its leadership while global competition focuses on high-end differentiation.