Why Stage Six Is the Most Critical Phase

If importing mobile phone LCD screen parts were a marathon, Stage Six would be the final sprint—and the one where most people trip. This is the moment your cargo arrives at the destination country and faces customs clearance, the most complex and time-sensitive part of the entire supply chain.

One small mistake here can freeze your shipment for weeks, rack up demurrage fees, and mess with your delivery promises. That’s why understanding this stage isn’t optional—it’s survival.

Overview of Destination Country Import Customs Clearance

Once your LCD screens land at the destination port, the spotlight shifts from logistics to compliance. Carriers, customs officers, and licensed clearance agents all step in. Think of it like airport immigration: your documents must be perfect, your declarations truthful, and your goods compliant with local rules.

Now let’s break down each step from 66 to 83, clearly and practically.

Step 66 – Destination Port Bill of Lading Exchange

Before you can touch your cargo, you need a Delivery Order (D/O). This requires exchanging the Original Bill of Lading or submitting a Telex Release guarantee to the carrier’s local agent.

Original B/Ls are old-school but powerful. Telex releases are faster but only work if the shipper approves them in advance. Miss this step, and your goods sit idle—like luggage stuck on the carousel forever.

Step 67 – Appointing a Licensed Import Customs Broker

Customs clearance isn’t DIY territory. You must appoint a locally licensed customs broker who understands destination-country regulations.

A good broker is like a tour guide through a bureaucratic jungle. A bad one? A fast track to fines, delays, and compliance nightmares. Always verify licenses and experience with electronics imports.

Step 68 – Preparing the Import Clearance Document Package

This is where paperwork becomes king. A standard document pack includes:

- Bill of Lading

- Commercial Invoice

- Packing List

- Sales Contract

- Certificate of Origin

- Import License (if required)

- Brand Authorization Letter (for branded LCDs)

Incomplete or inconsistent documents are the #1 reason shipments get stuck. Customs loves details—give them exactly what they want.

Step 69 – Import Declaration Submission

Your broker submits the import declaration into the customs system, declaring:

- HS code

- Product description

- Quantity and value

- Country of origin

For LCD screen parts, HS code accuracy is critical. One wrong digit can change tax rates or trigger inspections.

Step 70 – Customs Duty and Tax Assessment

Customs calculates duties based on:

- Declared value

- HS code

- Trade agreements

- Country of origin

Depending on the destination, this may include customs duty, VAT/GST, and consumption tax. LCD screens often fall under electronics categories with strict valuation scrutiny.

Step 71 – Payment of Duties and Taxes

Taxes must be paid through approved channels—bank transfer, customs accounts, or online portals. Timing matters. Late payments can trigger penalties or clearance suspension.

Pro tip: preload funds in your customs account to avoid last-minute scrambles.

Step 72 – Customs Document Review

Customs officers review your submission for:

- Consistency across documents

- Reasonable pricing

- Regulatory compliance

Red flags include undervaluation, vague descriptions, or missing authorizations. If everything checks out, you move forward. If not—welcome to deeper inspection.

Step 73 – Responding to Customs Valuation Challenges

If customs doubts your declared value, they may initiate a valuation inquiry. You’ll need proof like:

- Payment records

- Supplier invoices

- Transaction contracts

This step tests your transparency. Clean records make this painless. Messy ones? Expect delays.

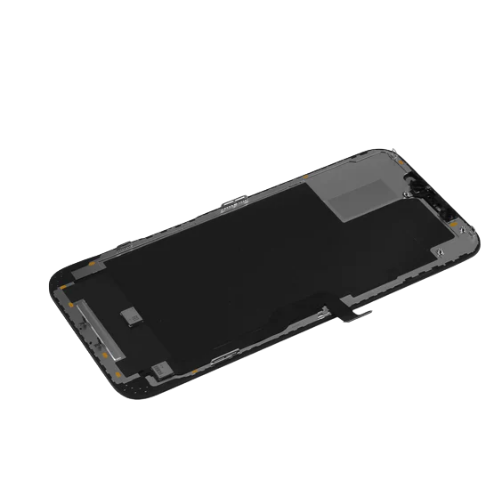

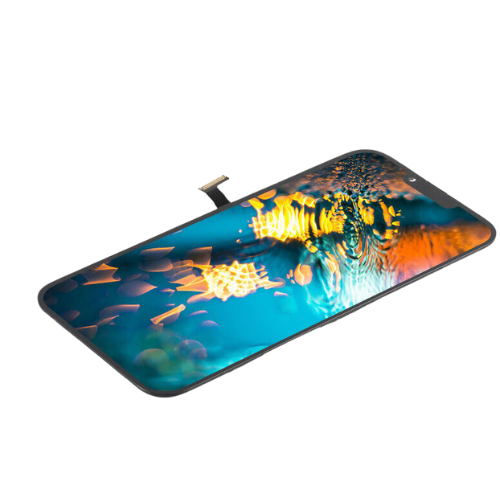

Step 74 – Physical Customs Inspection

Customs may open cartons to verify:

- Product type

- Quantity

- Labeling

- Consistency with declarations

LCD screens are fragile, so inspections must be handled carefully. Proper packaging reduces damage risks during checks.

Step 75 – Inspection and Quarantine (If Applicable)

Some countries require electronics to undergo:

- Safety compliance checks

- Communication standards review

- Environmental or recycling compliance

Skipping this step isn’t an option—it’s regulation, not suggestion.

Step 76 – Labeling and Marking Compliance

Labels must meet local rules, such as:

- Energy efficiency labels

- Recycling symbols

- Country-of-origin markings

Non-compliant labels can delay release or require relabeling at your cost.

Step 77 – Intellectual Property Rights (IPR) Inspection

Customs may check for trademark or patent infringement. If you’re importing branded LCD screens, authorization letters are essential.

Without them, goods may be seized—even if they’re legit.

Step 78 – Handling Cargo Detention

Detention happens due to:

- Missing documents

- Valuation disputes

- IPR issues

Fast communication with your broker is key. The sooner you respond, the sooner the clock stops bleeding money.

Step 79 – Customs Release Approval

Once all checks, payments, and inspections are complete, customs stamps the release. This is the green light—your goods are officially cleared.

Keep release documents on file. You’ll need them for audits or disputes.

Step 80 – Applying for Duty Exemptions or Refunds

If your LCD parts are used for:

- Processing trade

- Re-export manufacturing

You may qualify for duty exemptions or refunds. This requires extra paperwork but can significantly cut costs.

Step 81 – Bonded Warehouse Clearance (If Applicable)

Bonded warehouses allow you to store goods without paying import duties upfront. Taxes are paid only when goods enter the local market.

This is cash-flow magic for high-value LCD shipments.

Step 82 – Operations in Special Regulatory Zones

Free trade zones and bonded logistics parks offer:

- Simplified procedures

- Deferred tax payments

- Faster cargo movement

But rules differ. Know the process before routing shipments through these zones.

Step 83 – Managing Customs Compliance Records

Customs never forgets. A history of violations increases inspection rates. Clean compliance records, on the other hand, build trust and speed future clearances.

Think long-term. Every shipment builds your importer profile.

Conclusion

Stage Six is where importing mobile phone LCD screen parts from China either succeeds or collapses. It’s complex, paperwork-heavy, and unforgiving—but also completely manageable with the right preparation. Master these steps, work with licensed professionals, and treat compliance like an investment, not a cost. When customs clearance runs smoothly, everything else falls into place.

FAQs

1. Why is customs clearance the most critical stage of LCD imports?

Because delays here directly affect delivery time, costs, and customer commitments.

2. Do LCD screen parts always require inspection?

Not always, but electronics are high-risk items and frequently selected.

3. What causes customs valuation disputes?

Undervaluation, inconsistent invoices, or unclear payment records.

4. Are branded LCD screens harder to clear?

Yes, due to intellectual property checks and authorization requirements.

5. How can I reduce customs clearance risks long-term?

Maintain accurate documentation, comply with regulations, and build a clean import history.