Introduction to Smartphone LCD Screen Imports

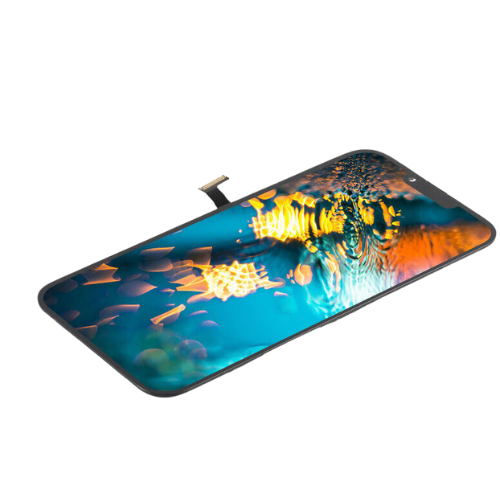

Smartphone LCD screens are the beating heart of modern mobile devices. Knæk en, og telefonen er praktisk talt blind. That’s why the global demand for replacement and original smartphone LCD screens keeps growing year after year. From repair shops to large distributors, importing mobile phone LCD screens has become a daily business operation rather than a niche trade.

Men her er fangsten: importing smartphone LCD screens isn’t just about finding a supplier and shipping the goods. Customs clearance procedures, documentation requirements, tariffs, and tax policies can make or break your profit margin. Think of customs clearance like airport security for goods—miss one document, and everything gets delayed.

Let’s break it all down in plain English.

Understanding Import Customs Clearance for Smartphone LCD Screens

Customs clearance is the legal process of declaring goods to customs authorities when they enter a country. For smartphone LCD screens, this process is especially important because these products fall under electronic components, which are often subject to strict inspection and valuation rules.

Customs authorities focus on:

- Product classification

- Deklareret værdi

- Oprindelsesland

- Intended commercial use

Get any of these wrong, and you may face delays, penalties, or even shipment seizure.

HS Code Classification for Smartphone LCD Screens

The HS (Harmonized System) code is the backbone of customs clearance. It determines how much duty you pay and what regulations apply.

Smartphone LCD screens are usually classified under HS codes related to:

- Liquid crystal display modules

- Parts and accessories of mobile phones

Choosing the correct HS code is not optional—it’s mandatory. A wrong code can result in higher duties or customs audits. Always align the HS code with the actual product function, not just what the supplier suggests.

Required Import Documents for Smartphone LCD Screens

Paperwork may feel boring, but in customs clearance, documents are king.

Kommerciel faktura

This document shows the transaction value. It must include:

- Buyer and seller details

- Produktbeskrivelse (f.eks., smartphone LCD display module)

- Unit price and total value

- Currency and payment terms

Accuracy here is critical because customs uses this to calculate duties and taxes.

Pakkeliste

The packing list details how the goods are packed:

- Number of cartons

- Gross and net weight

- Quantity per package

Customs uses this during inspections to verify physical goods against declared data.

Salgskontrakt

The contract proves that the trade is legitimate. It usually includes:

- Produktspecifikationer

- Delivery terms (Incoterms)

- Payment conditions

While not always inspected line by line, customs may request it during audits.

Oprindelsescertifikat

This document shows where the LCD screens were manufactured. It plays a key role in:

- Determining applicable tariff rates

- Applying free trade agreement benefits

Certificates of origin can be:

- Non-preferential

- Preferential (used for tariff reductions)

Bill of Lading or Air Waybill

This is the transport document issued by the carrier. It confirms shipment details and ownership of the goods.

Import Declaration Form

This is submitted electronically or manually to customs, summarizing all shipment information.

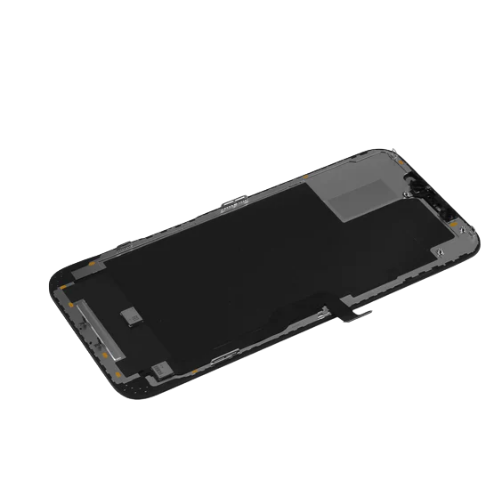

Special Compliance Requirements for LCD Screen Imports

Customs often requires detailed product descriptions for LCD screens, including:

- Skærmtype (LCD, Tft, IPS)

- Størrelse og opløsning

- Whether it’s assembled or semi-finished

Branded screens may also require brand authorization or trademark declarations in some countries.

Import Tariffs for Smartphone LCD Screens

Import duties usually consist of:

- Basic import duty

- Value-added tax (VAT)

The basic duty rate varies by country and HS code, often ranging from 0% til 10%. VAT is typically calculated on the CIF value (Koste + Forsikring + Fragt).

Taxable value formula:

CIF værdi + import duty = VAT base

Understanding this formula helps you forecast landed costs accurately.

How to Check Import Tariff Rates

You can check tariff rates through:

- Official customs tariff databases

- National customs websites

- Licensed customs brokers

For et tip: Always double-check tariff rates before shipment. Policies change, and yesterday’s rate may not apply today.

Import Tax Refund and Rebate Policies

If imported smartphone LCD screens are later exported again—common in repair and distribution hubs—you may be eligible for tax refunds.

Import Tax Refund

Some countries allow refunding import VAT if goods are re-exported within a specified period.

Export VAT Rebate

In manufacturing or re-export scenarios, export VAT rebates may apply. LCD-related products often enjoy moderate rebate rates, afhængig af klassificering.

Always confirm rebate eligibility before planning large-volume imports.

Cost Optimization Strategies for Importers

Smart importers don’t just clear customs—they optimize it.

- Choose favorable Incoterms like FOB or CIF wisely

- Use free trade agreements when applicable

- Consolidate shipments to reduce per-unit logistics costs

Think of customs strategy as a chess game, not a dice roll.

Common Customs Clearance Risks and How to Avoid Them

Typical pitfalls include:

- Inconsistent invoice values

- Vague product descriptions

- Incorrect HS codes

The solution? Consistency, transparency, and preparation.

Typical Customs Clearance Process Step by Step

- Prepare documents before shipment arrival

- Submit customs declaration

- Customs inspection (om nødvendigt)

- Pay duties and taxes

- Goods released

Smooth clearance is all about preparation, not luck.

Working with Customs Brokers and Freight Forwarders

If you’re importing regularly, a professional broker is worth every penny. They:

- Handle declarations

- Resolve HS disputes

- Save time and reduce risk

Choose partners with electronics import experience, not general cargo only.

Case Study: Importing Smartphone LCD Screens from China

A distributor imports 1,000 LCD skærme:

- Deklareret værdi: USD 30,000

- Import duty: 5%

- VAT: 13%

Proper documentation and HS code usage results in smooth clearance within two working days—no delays, no penalties.

Future Trends in Smartphone LCD Screen Imports

Digital customs systems, pre-declaration, and AI-assisted inspections are becoming the norm. Transparency and compliance will matter more than ever.

Konklusion

Importing smartphone LCD screens is a profitable business—but only if you master customs clearance and tariff rules. With the right documents, correct HS codes, and a clear understanding of duties and tax rebates, you turn customs from a roadblock into a fast lane. Treat compliance as part of your business strategy, and your imports will move as smoothly as a new touchscreen swipe.

FAQS

What documents are required to import smartphone LCD screens?

You typically need a commercial invoice, pakkeliste, contract, certificate of origin, and transport document.

Are smartphone LCD screens subject to import duty?

Ja, most countries apply basic import duty and VAT, depending on HS code classification.

How can I reduce import taxes legally?

Use correct HS codes, free trade agreements, and explore re-export tax refund policies.

Is a certificate of origin mandatory?

Ja, especially if you want to apply for preferential tariff rates.

Can I import branded LCD screens without authorization?

Some countries require brand authorization or trademark filing—always check local regulations.