Introduction to LCD Screen Procurement

Smartphone LCD screens—although more affordable than OLEDs—still carry a surprisingly complex cost structure. Si vous êtes un professionnel des achats, understanding what truly drives the price can give you massive negotiating power. And with LCD still widely used in mid-range and budget devices, knowing the cost breakdown is essential for smarter sourcing.

Why LCD Cost Transparency Matters

Without visibility into component-level pricing, buyers often end up accepting whatever price suppliers quote. But LCD modules consist of multiple materials, processes, and ICs—each with its own market price fluctuations. When you know which parts cost the most, you can challenge suppliers with confidence.

Common Challenges for Buyers

Procurement teams usually face:

- Vague or incomplete cost breakdowns

- Highly variable yield rates

- Suppliers bundling key components to hide true cost

- Frequent panel price fluctuations

A clear cost model helps overcome these obstacles.

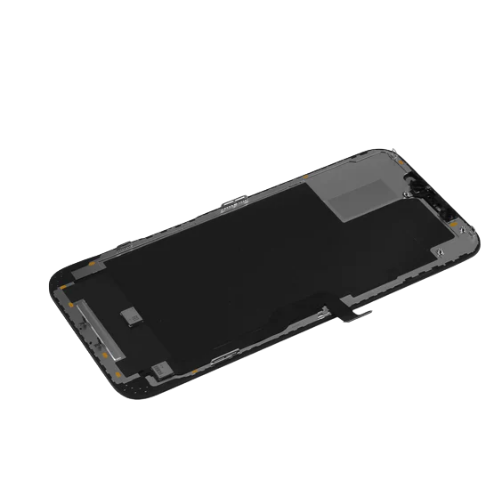

Key Components of a Smartphone LCD Screen

Each LCD screen contains several layers and modules. Let’s break down the major cost contributors.

Cover Glass

Often the first thing a user touches, the cover glass impacts durability and aesthetics.

Types of Cover Glass

- Soda-Lime Glass – Cheapest, used in low-end phones.

- Aluminosilicate Glass – Mid-range option with better scratch resistance.

- Strengthened Glass (par ex., Verre Gorille) – Premium-grade, significantly higher cost.

Cost Drivers

- Épaisseur

- Hardness (Mohs rating)

- Whether it uses chemical tempering

- 2D vs. 2.5D vs. 3D curvature

- Surface treatments like AF coating

High-curvature designs can increase cost by 20–40%.

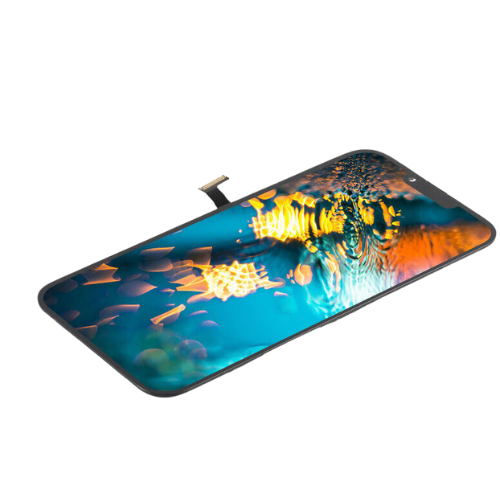

LCD Display Module

This includes the TFT panel and the color filter.

TFT Panel Structure

The TFT array is one of the most expensive parts—especially if it uses:

- Higher resolutions (FHD, FHD+)

- LTPS technology vs. a-Si

LTPS can cost up to 30% more, but provides better power efficiency and sharper visuals.

Color Filter

This layer defines color reproduction. Higher-quality filters—especially those designed for wide-gamut displays—raise material cost.

Touch Panel / Touch Module

Touch sensing can be integrated (Dans la cellule), semi-integrated (Sur cellule), or separated (OGS).

OGS vs. In-Cell vs. Sur cellule

- OGS (One Glass Solution) – Lower cost, external touch layer.

- Sur cellule – Touch sensors built into the panel surface.

- Dans la cellule – Touch sensors built into the LCD structure, used in premium designs.

In-Cell requires more precise manufacturing, raising both cost and risk of defects.

Touch Controller IC

The touch IC handles sensing and signal processing. Its cost depends on:

- Number of channels

- Sampling rate

- Whether it supports stylus input

- Marque (par ex., Goodix vs. FocalTech)

Backlight Module (BLEU)

LCD screens require LED backlighting, a major cost component.

LED Chips and Light Guide Plate

LED chips vary by brightness, efficacité, and brand. The Light Guide Plate (LGP) converts point light into uniform surface light—higher optical quality means higher cost.

Diffusion Films and Reflector

These layers increase luminance and uniformity. Multiple film layers may be stacked, and film price fluctuates based on resin market conditions.

IC de conducteur (Display Driver IC, DDIC)

The DDIC processes display signals and controls pixel operation.

Key Specifications That Impact Price

- Supported resolution

- Taux de rafraîchissement

- Efficacité énergétique

- Interface type (MIPI, eDP)

- Brand and availability (chip shortages can double prices)

High-resolution ICs can push up overall screen cost by 10–20%.

Optical Bonding / Lamination Process

This step combines the cover glass, touch layer, and LCD panel.

OCA vs. LOCAL

- OCA (Optically Clear Adhesive) – Cleaner, more consistent results, popular for mass production.

- LOCAL (Liquid Optical Clear Adhesive) – Better for curved surfaces, but introduces slower curing time.

Automation vs. Manual Assembly

Automated bonding improves yield, but increases equipment cost. Manual bonding is cheaper but often results in higher defect rates.

Higher yield → lower cost; lower yield → higher price.

Additional Cost Factors Beyond Components

Yield Rate and Production Loss

Defects in bonding, BLU assembly, or TFT lines drastically affect cost. In-Cell modules often have the lowest yield.

Labor and Factory Overheads

Labor costs vary by region (China vs. Vietnam vs. Inde). Factories with more automation generally offer more stable pricing.

Packaging and Reliability Testing

Drop tests, thermal tests, and vibration tests add both time and cost but ensure fewer returns.

Supply Chain and Logistics

Expédition, customs, and storage also contribute to the final price—especially for fragile LCD modules.

How Procurement Can Identify Cost Leverage Points

High-Impact Negotiation Points

Buyers can push back strongest on:

- Cover glass type upgrades

- BLU film stack configuration

- Touch module technology (OGS vs. Dans la cellule)

- Driver IC source and brand

Component Substitution Opportunities

Switching to:

- Lower-spec touch IC

- Standard LGP

- Local glass suppliers

- Alternative backlight film suppliers

…can often shave 5–15% off module cost.

Supplier Capability and Tiering

Top-tier suppliers offer stability but higher prices. Mid-tier vendors may offer better negotiation room—if their yield is acceptable.

Case Study: Typical LCD Module Cost Distribution

A typical mid-range LCD module breakdown might look like:

- TFT Panel: 35–40%

- Rétroéclairage: 20–25%

- Cover Glass: 10–15%

- Touch Module: 10–15%

- IC de conducteur: 10–12%

- Lamination Process & Assemblée: 5–8%

This model helps you pinpoint exactly where suppliers are padding margins.

Best Practices for LCD Procurement Negotiation

Benchmarking

Compare pricing across:

- Multiple suppliers

- Panel types

- Regions

- Quarter-by-quarter market trends

Volume Planning

Bigger orders → better pricing tiers.

Staggered forecasts = higher risk premiums.

Multi-Sourcing

Avoid relying on a single supplier to reduce cost escalation risk.

Conclusion

Understanding the cost structure of smartphone LCD screens empowers procurement teams to negotiate smarter, detect supplier margin padding, and choose the right alternatives. By analyzing each component—from glass to backlight to ICs—you gain control over the purchasing process and reduce unnecessary cost.

LCD modules are complex, but with a clear breakdown, you can turn complexity into negotiation strength.

FAQ

1. What is the most expensive part of a smartphone LCD screen?

The TFT panel usually accounts for the largest percentage of the cost.

2. Does In-Cell touch technology always cost more?

Generally yes—In-Cell requires higher precision manufacturing and has lower yield.

3. How much does the backlight contribute to cost?

Typically 20–25% of the total module cost.

4. What impacts driver IC pricing the most?

Resolution support, brand, and global chip supply conditions.

5. Can buyers negotiate down cover glass cost?

Absolutely—switching to lower-spec or local glass suppliers can reduce cost by 10–20%.