Introduction to Spain’s Smartphone and Repair Ecosystem

Spain’s smartphone market isn’t just about shiny new devices anymore. It’s about longevity, sustainability, and value. In 2025, Spain stands out as one of Europe’s most mature smartphone ecosystems, where device sales, mobile repair services, and spare parts like LCD and OLED screens are tightly connected. Think of it like a living organism—when new phone sales slow down, the repair market breathes new life into old devices.

Executive Summary of the 2025 Market

By 2025, Apple, Samsung, and Xiaomi dominate more than 75% of Spain’s smartphone market. At the same time, the mobile phone repair industry has quietly grown into a powerhouse, supported by EU sustainability policies, rising device prices, and consumer awareness. Screen repairs—especially OLED—account for 60–70% of all repair requests, making mobile LCD and OLED screens the single most important component in the aftermarket.

Chapter 1: Overview of the Spanish Smartphone Market (2025)

Market Size and Growth Trends

Spain’s smartphone market has reached saturation. Most consumers already own a smartphone, which means growth now comes from upgrades rather than first-time buyers. Replacement cycles have stretched from 24 months to nearly 36–40 months, directly boosting demand for repairs.

Brand Landscape Evolution

Apple’s Premium Market Leadership

Apple has mastered Spain’s premium segment. Thanks to carrier financing, trade-in programs, and deep brand loyalty, iPhones—especially the iPhone 15 and 16 series—are everywhere. High prices, however, mean users are far more likely to repair than replace.

Samsung’s Balanced High–Mid Strategy

Samsung plays both sides beautifully. The Galaxy S series battles Apple at the top, while the Galaxy A series dominates mid-range shelves. This wide coverage translates into massive repair demand across price segments.

Xiaomi’s Value-for-Money Expansion

Xiaomi filled the gap left by Huawei. Redmi and POCO devices rule the budget and mid-range market. These phones are repair-heavy, especially screen and battery replacements, due to high usage and thinner margins on new devices.

Decline of Legacy Brands

Huawei’s fall from grace in Spain is dramatic. Without Google services, its market share shrank rapidly, leaving behind a trail of older devices that still require repair support.

Chapter 2: Consumer Behavior and Technology Trends

Shift Toward Mid-Range Smartphones

Spanish consumers are pragmatic. Why spend €1,200 when a €350 phone does the job? This mindset fuels mid-range sales and, later, mid-range repairs.

Sustainability and Ethical Consumption

Over 77% of Spanish consumers prefer repairing devices to reduce e-waste. Repairing a phone is no longer “cheap”—it’s responsible.

5G, 5G-A, and AI Integration

5G is mainstream, and Spain is already testing 5G-A. AI-powered photography, voice assistants, and diagnostics are pushing hardware harder, increasing long-term repair needs.

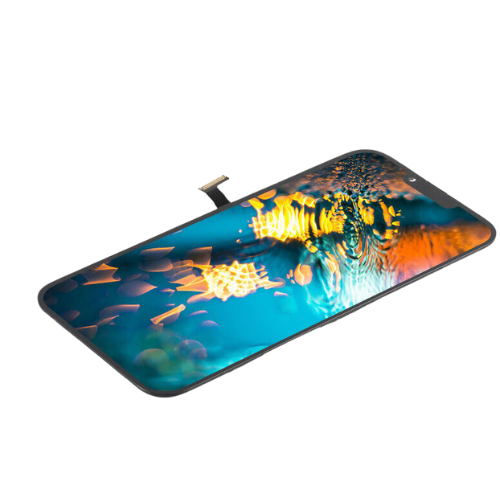

Display Technology Trends (OLED vs LCD)

LCD is fading fast. OLED and AMOLED screens are now standard, even in mid-range phones. This shift raises repair complexity and costs.

Chapter 3: Spain Mobile Phone Repair Market Analysis

Market Size and Growth Rate

Spain hosts over 4,000 registered repair businesses, growing at around 3.6% annually. It’s one of Europe’s most stable repair markets.

Structure of the Repair Industry

The market is dominated by small, independent repair shops—quick, flexible, and price-competitive.

Independent Repair Shops vs Official Service Centers

Official centers offer peace of mind but charge premium prices. Independent shops win on speed and affordability.

Chapter 4: Key Repair Services and Demand Breakdown

Screen Repair and Replacement Dominance

Screen repairs represent 60–70% of all repairs. OLED screens, while beautiful, are fragile and expensive.

Battery Replacement Trends

After two years, battery health drops. Battery replacement is the second most common service.

Other Common Repairs

Charging ports, cameras, sensors, and software issues are steadily rising, especially with AI-driven systems.

Chapter 5: Mobile Phone LCD & OLED Screen Market

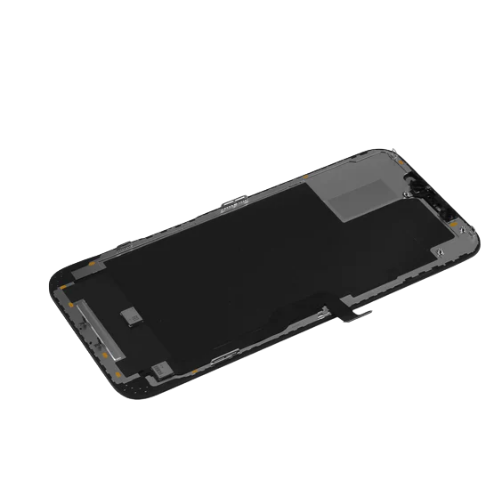

Transition from LCD to OLED

OLED screens are thinner, brighter, and more fragile. Repairs require higher skill and better tools.

Cost Structure of Screen Replacement

Official OLED replacements can cost €250–€400. Independent shops offer alternatives at €120–€200.

Aftermarket vs Original Screens

High-quality aftermarket screens are the backbone of the repair industry, offering balance between cost and quality.

Chapter 6: Supply Chain and Parts Distribution

Role of China in the Global Supply Chain

China remains the world’s factory for mobile phone screens. Most aftermarket OLED and LCD screens originate there.

Pricing, Margins, and Quality Control

Repair shops average 25–35% margins on screen repairs. Supplier reliability is everything.

Logistics and Import Considerations

Fast shipping, customs compliance, and consistent quality determine competitiveness.

Chapter 7: Policy, Regulation, and Right to Repair

EU Right-to-Repair Law

From 2026, manufacturers must provide parts and manuals for 7–10 years. This is a game changer.

Impact on Repair Businesses

Lower barriers, better access to parts, and increased consumer trust.

Long-Term Regulatory Effects

Repair becomes mainstream, professional, and standardized.

Chapter 8: Competitive Landscape

Official Brand Repair Networks

High quality, high cost, limited flexibility.

Independent Repair Providers (IRPs)

Fast, affordable, and local—these shops dominate volume.

Repair Software and Tool Providers

Tools like diagnostics software and repair guides are becoming essential.

Chapter 9: Future Trends and Market Opportunities

AI-Powered Repair Software

Smart diagnostics reduce time and errors.

Refurbished Phone Market Growth

Refurbished phones are booming, supported by repair expertise.

New Business Models

Insurance partnerships, subscription repairs, and on-site services are rising.

Conclusion

Spain’s 2025 smartphone market is mature, competitive, and deeply intertwined with its repair ecosystem. As OLED screens dominate and devices grow more expensive, repair—especially screen replacement—becomes the backbone of the industry. Backed by EU policy and sustainability awareness, Spain’s mobile repair and LCD/OLED screen market stands at the edge of long-term, scalable growth.

FAQs

1. Why is screen repair so popular in Spain?

Because OLED screens are fragile and expensive, making repair more economical than replacement.

2. Are aftermarket screens reliable?

High-quality aftermarket screens offer excellent performance at lower cost.

3. How does EU policy affect phone repair?

The Right-to-Repair law lowers costs and increases access to parts.

4. Which brands dominate Spain’s repair market?

Apple, Samsung, and Xiaomi generate the highest repair demand.

5. Is the repair market still growing?

Yes, with steady growth driven by sustainability and high phone prices.