Εισαγωγή

Why Europe Matters to Xiaomi

Europe is not just another overseas market for Xiaomi—it’s the final exam. If Asia is where scale is built and emerging markets are where volume grows, then Europe is where brands are truly tested. Mature consumers, strict regulations, strong carrier influence, and deep-rooted brand loyalty make Europe one of the toughest smartphone arenas on the planet.

From Challenger to Top-Tier Contender

Σε 2025, Xiaomi didn’t just show up—it made noise. By overtaking Apple in market share during Q2, Xiaomi signaled that it’s no longer content being the “cheap alternative.” It wants a seat at the premium table, even if that chair is still slightly wobbly.

Εκτελεστική Περίληψη

A Historic Breakthrough in Q2 2025

The second quarter of 2025 marked a milestone. Xiaomi captured approximately 23% of the European smartphone market, surpassing Apple for the first time in history and securing second place behind Samsung. This wasn’t a lucky quarter—it was the result of years of groundwork.

What This Shift Really Means

This achievement reflects more than shipment numbers. It shows that Chinese brands, led by Xiaomi, are transitioning from aggressive expansion to value-driven competition. The big question now: can Xiaomi turn momentum into long-term brand equity?

Overview of the European Smartphone Market

Market Maturity and Saturation

Europe’s smartphone market is like a crowded subway at rush hour—everyone’s already inside. Growth doesn’t come from new users but from convincing people to switch brands or upgrade faster.

Consumer Behavior Trends (2025–2026)

European consumers are pragmatic. Inflation and economic uncertainty have made buyers more price-conscious, but not at the expense of quality.

Budget Sensitivity vs. Brand Loyalty

Here lies the paradox: consumers want better deals, yet remain emotionally attached to Apple and Samsung. Xiaomi’s challenge is to break habits without breaking trust.

Xiaomi’s Market Performance in Europe

Market Share Growth Explained

With a year-on-year growth of around 11%, Xiaomi was the only top-three brand to grow in Q2 2025. Samsung and Apple both declined, opening a rare window of opportunity.

Shipment Data vs. Active User Data

Shipment-based reports show Xiaomi as a powerhouse. Ωστόσο, usage-based data tells a more conservative story.

Understanding the Data Gap

This gap suggests Xiaomi sells a lot of phones—but many are entry or mid-range devices. Market presence is strong, but premium mindshare still lags behind.

Competitive Landscape Analysis

Samsung’s Defensive Position

Samsung remains Europe’s leader thanks to its wide portfolio and carrier relationships. Yet declining shipments hint at fatigue.

Apple’s Premium Stronghold

Apple may have slipped to third place, but its grip on the high-end segment remains ironclad. Loyalty is its secret weapon.

Emerging Rivals: Motorola and realme

Motorola’s decline and realme’s rise show that the mid-range battlefield is far from settled. Xiaomi can’t afford complacency.

Dual-Brand Strategy: Xiaomi + Redmi

Redmi as the Volume Engine

Redmi thrives where wallets are tight. It delivers specs that feel like a bargain, especially during economic downturns.

Xiaomi Brand as the Image Builder

While Redmi brings traffic, Xiaomi-branded flagships are meant to build prestige.

Clear Segmentation or Brand Confusion?

The line between Redmi and Xiaomi sometimes blurs. Clearer differentiation is essential to avoid self-cannibalization.

Product Strategy and Portfolio Optimization

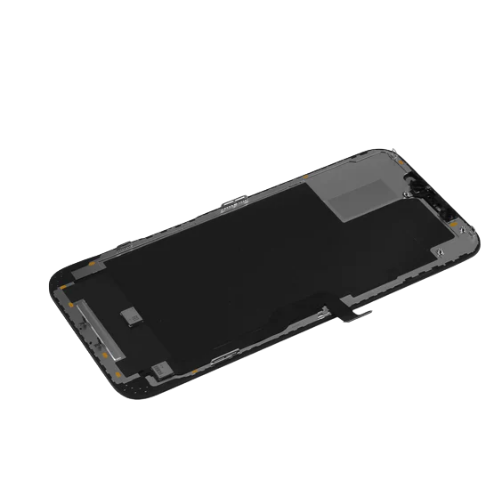

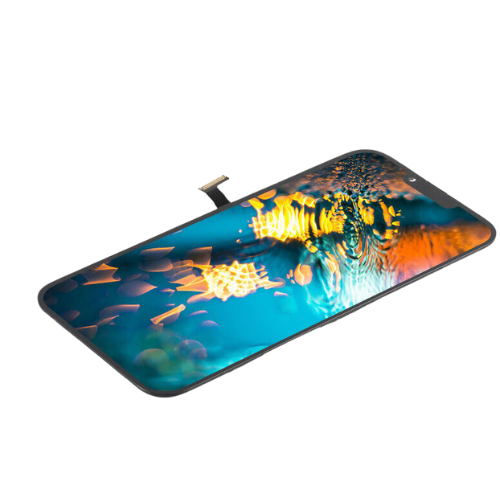

Flagship Series and Foldables

Xiaomi’s digital series and foldable phones are technological showcases. They prove Xiaomi can innovate, not just compete on price.

Mid-Range Domination

This is Xiaomi’s comfort zone. Strong specs, aggressive pricing, and fast refresh cycles keep competitors on their toes.

Pricing Strategy in Inflationary Europe

Xiaomi’s flexible pricing acts like shock absorbers, helping it navigate economic bumps better than rigid premium brands.

Channel Innovation and Localization

Strategic Partnership with AliExpress

The collaboration with AliExpress is a game changer. It’s not just about selling phones—it’s about owning the customer relationship.

Operator Channels vs. Direct-to-Consumer

While carriers offer scale, direct channels offer control. Xiaomi is wisely balancing both.

Building a Localized Brand Experience

Localized content, επιμελητεία, and after-sales support are turning Xiaomi from a foreign brand into a familiar name.

The “Human–Car–Home” Ecosystem Advantage

Smartphones as the Control Hub

In Xiaomi’s world, the phone is the brain, not the body. Everything connects back to it.

AIoT Growth in Europe

With AIoT revenue surging over 60%, Xiaomi is quietly embedding itself into European homes.

Ecosystem Lock-In Effect

Once users buy into the ecosystem, leaving feels like moving houses—possible, but painful.

Brand Perception and the Premium Dilemma

The “Value-for-Money” Label

This label built Xiaomi—but it may also box it in.

Can Xiaomi Be Truly Premium?

Premium isn’t just hardware. It’s storytelling, συνοχή, and emotional connection.

Lessons from Apple and Samsung

Both brands sell feelings as much as features. Xiaomi is learning—but it’s a marathon, not a sprint.

Financial Indicators and ASP Challenges

ASP Decline Explained

A higher share of budget models dragged down average selling prices in Q2 2025.

Scale vs. Profitability

More units don’t always mean more profit. Xiaomi must balance ambition with margins.

Is Growth Sustainable?

Yes—but only if premium devices gain real traction.

Key Risks and Challenges Ahead

Intensifying Competition

Price wars are brutal, and innovation cycles are shortening.

Economic and Geopolitical Risks

Inflation, trade policies, and geopolitical tensions add layers of uncertainty.

Regulatory and Trade Uncertainty

Compliance costs and policy shifts can quickly erode advantages.

Strategic Outlook for 2025–2026

Entering the 200 Million Club

Xiaomi aims to join Samsung and Apple as a 200-million-unit annual seller.

Europe as a Long-Term Battlefield

Success in Europe isn’t optional—it’s existential.

Στρατηγικές Συστάσεις

Brand Building Priorities

Focus flagship marketing on storytelling, not specs.

Product and Ecosystem Integration

Bundle smartphones with AIoT products to create lifestyle solutions.

Channel and Retail Optimization

Turn offline stores into immersive ecosystem experience centers.

Σύναψη

From Breaking Through to Breaking Away

Xiaomi’s rise in Europe is impressive, but the real challenge lies ahead. Market share can be won with pricing and speed; brand value takes patience and belief. The next chapter isn’t about chasing Apple—it’s about becoming unmistakably Xiaomi. If it succeeds, this won’t just be a corporate victory, but a blueprint for Chinese brands aiming global.

Συχνές ερωτήσεις

1. Why did Xiaomi surpass Apple in Europe in 2025?

Due to strong mid-range sales, flexible pricing, and competitors’ shipment declines.

2. Is Xiaomi considered a premium brand in Europe?

Not fully yet. It’s respected for value, but premium perception is still evolving.

3. What role does Redmi play in Xiaomi’s strategy?

Redmi drives volume and market penetration, especially among budget-conscious buyers.

4. How important is the AIoT ecosystem for Xiaomi?

It’s a key differentiator that increases user loyalty and long-term value.

5. Can Xiaomi maintain its growth through 2026?

Ναί, but only if it successfully balances scale with premium brand building.