Introduction

Le marché colombien des smartphones est l’un des marchés les plus dynamiques et les plus équilibrés d’Amérique latine.. Il reflète un écosystème en pleine maturité, façonné par une connectivité numérique croissante., une population jeune féru de technologie, et une gamme compétitive de marques mondiales et régionales. Malgré les pressions économiques, Les consommateurs colombiens continuent de mettre régulièrement à niveau leurs appareils, rendant le marché un terrain fertile pour les acteurs premium et axés sur la valeur.

Aperçu du marché

Le marché colombien des smartphones en 2025 se caractérise par une croissance modeste mais régulière. Même si les volumes de ventes globaux ont stagné par rapport à l'expansion rapide des années passées, le marché continue d'évoluer grâce à l'innovation, accessibilité accrue au financement, et une préférence des consommateurs pour les marques fiables. Selon StatCounter Global Stats, Apple and Samsung lead the way, capturing most of the market share.

Market Size and Recent Growth

Following the pandemic, the Latin American smartphone sector experienced a notable rebound, with regional shipments climbing 15% dans 2024 (Developing Telecoms). Colombia contributed to this recovery, maintaining consistent consumer demand driven by carrier promotions and trade-in programs.

Analysts estimate Colombia’s market value in the low billions of USD, with a projected modest CAGR into 2030 (深度市场洞察).

Market Structure

Sales Channels

Colombia’s smartphone sales occur through a mix of online and offline channels. The key players include:

- Carrier stores like Movistar, Tigo, and Claro (Movistar Store)

- E-commerce platforms such as MercadoLibre

- Retail chains and independent shops

Les forfaits opérateurs sont cruciaux car la plupart des appareils haut de gamme sont achetés sur financement à tempérament, rendre les modèles haut de gamme comme l'iPhone plus accessibles.

Segments d'acheteurs

- Consommateurs haut de gamme choisissez généralement les modèles iPhone ou Samsung Galaxy S.

- Acheteurs milieu de gamme préférez Samsung série A, Xiaomi, ou Motorola.

- Segment budgétaire – dominé par les marques Transsion (Techno, Infinix) et des importations abordables.

Principaux acteurs et part de marché

Dès 2025, Apple occupe une position dominante en Colombie avec environ 30% partager, suivi de Samsung à environ 23%, alors Xiaomi et Motorola (StatCounter Global Stats).

Alors que Samsung est en tête de l'Amérique latine au classement général, La Colombie se distingue comme l’un des marchés iPhone les plus solides dans la région.

Motorola et Xiaomi maintiennent leur dynamique grâce à des produits axés sur la valeur, tandis que les téléphones d’entrée de gamme de Transsion gagnent rapidement en visibilité.

La force d’Apple en Colombie

Apple’s success in Colombia is due to carrier financing and consumer trust. Programs like trade-in deals and long-term installment payments have made premium iPhones more attainable. This strategy allows Apple to grow faster in Colombia compared to other Latin American countries (Counterpoint Research).

Mid-Range Market Dynamics

Le mid-range segment drives the majority of unit sales. Samsung’s Galaxy A-series, Xiaomi’s Redmi line, and Motorola’s G-series dominate this category.

For many Colombians, price-to-performance is key. Brands that offer strong specifications at accessible prices are the winners here. Transsion’s Tecno and Infinix are also growing in the sub-$200 range, especially outside major cities.

Most Popular Models

Based on retail and carrier listings, le most popular smartphones in Colombia (2024–2025) include:

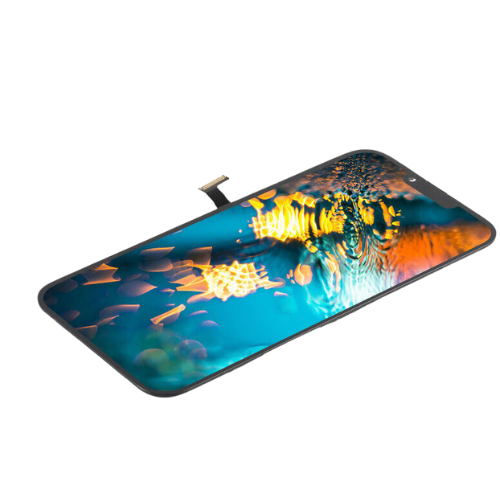

- AppleiPhone 15 / 15 Pro / 16 série (MercadoLibre)

- Samsung Galaxy A55, A16, and S24 series (efani.com)

- Xiaomi Redmi Note series — appealing for strong specs under $400

- Motorola Moto G and Edge lines — popular in mid-tier

These models are repeatedly highlighted in carrier promotions and online bestseller lists. Cependant, official unit rankings remain proprietary to agencies like Counterpoint et Canalyses.

Consumer Preferences

Colombian buyers demonstrate strong brand loyalty once they settle on a trusted vendor. Price sensitivity remains high, yet buyers expect premium design and camera performance even in budget phones.

Installment purchases are a major enabler — many consumers upgrade through 12–24 month payment plans via carriers.

Technology Trends

5G Expansion

5G is still rolling out across Colombia, but major carriers like Claro et Tigo are accelerating network coverage. As this happens, 5G-ready smartphones are becoming more desirable — particularly mid- and upper-range models (Counterpoint Research).

AI Integration

Le 2025 smartphone wave brings AI-driven cameras, assistants, and photo tools. Colombian consumers are receptive to these innovations, though adoption is constrained by affordability. Brands that balance AI features with price competitiveness will have an advantage.

Competitive Landscape

Competition is intense across segments. Samsung and Apple lead in branding and consumer loyalty, while Xiaomi, Motorola, and Transsion compete aggressively on price and availability.

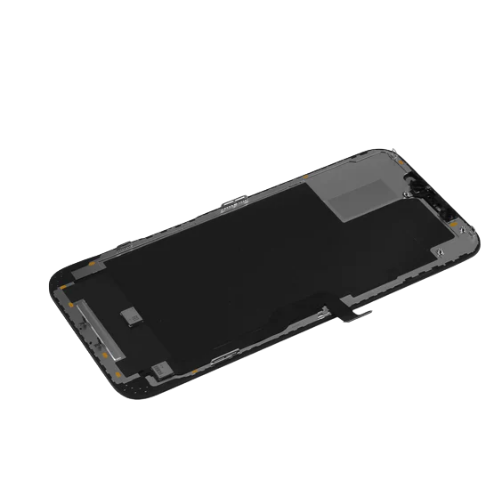

After-sales service and local warranty support are emerging differentiators — users increasingly value repair convenience.

Risks and Challenges

The Colombian market faces certain risks:

- Currency fluctuations are affecting import costs

- High tariffs and logistics costs for imported devices

- Crowded mid-range market with limited differentiation

These factors can pressure profit margins, especially for new entrants.

Opportunities for New Entrants

For brands eyeing Colombia, opportunities include:

- Targeting premium users through carrier partnerships and financing

- Launching AI and camera-focused phones to attract tech enthusiasts

- Offering localized after-sales services to build long-term trust

Urban centers like Bogotá and Medellín are particularly receptive to tech-forward products.

Strategic Recommendations

- Premium Strategy:

Build partnerships with carriers for financing programs, prioritize iPhone and flagship Android visibility. - Mid-Market Strategy:

Focus on performance-to-price ratio and local promotions. Offer warranties and service centers to boost confidence. - Distribution Focus:

Combine online sales via MercadoLibre with offline reach through Movistar, Claro, and Tigo stores.

Conclusion

Colombia’s smartphone market in 2025 represents a mature yet opportunity-rich environment. Apple leads in the premium tier, Samsung maintains strong brand equity, and Xiaomi and Motorola dominate mid-range sales. The rise of Transsion brands further diversifies the entry-level segment.

As 5G and AI reshape user expectations, the market’s future will hinge on how brands balance innovation, affordability, et l'accessibilité.

FAQ

1. Which brand leads the smartphone market in Colombia?

Apple currently leads, followed closely by Samsung, according to StatCounter.

2. What is the most popular smartphone model in Colombia?

Recent iPhone (15/16) and Samsung Galaxy A-series models are among the most purchased.

3. Are Chinese brands popular in Colombia?

Yes — Xiaomi, Techno, and Infinix are popular for their strong specs and low prices.

4. How does 5G adoption affect smartphone demand?

As coverage expands, more consumers prefer 5G-ready phones, influencing upgrade cycles.

5. What are the key opportunities for new entrants?

Partnering with carriers, offering localized support, and focusing on camera/AI innovation are the top opportunities.