Pasiuna

Nahunahuna ba nimo kung ngano nga ang mga smartphones sa Samsung kanunay nga adunay mas maayo nga mga pasundayag kaysa sa ilang mga kakompetensya, Bisan kadtong gipagawas sa parehas nga tuig? Bisan kung mas taas ang kahayag, Mga kolor nga kolor, o labi ka maayo nga kahusayan sa kuryente, Ang Samsung kanunay nga nagtakda sa benchmark. Ang hinungdan nga wala magbutang sa kabag-ohan, Apan sa usa ka mabinantayon nga orkanteng instrado sa suplay sa suplay nga gidumala sa Gipakita ang Samsung, Ang Nag-una nga Iglala sa Oled sa Kalibutan.

Atong ibalik ang mga layer sa diskarte sa pagpakita sa Samsung sa Samsung ug pagbukas kung giunsa kini pagtukod a Pyramid sa teknolohiya sa screen nga impluwensya dili lamang sa kaugalingon nga galaksiya nga linya sa galaksiya apan usab ang mga smartphone sa pinakadako nga kaatbang niini.

Ang istruktura sa Pyramid sa Samsung Ipakita

Wala gihatag sa Samsung ang tanan nga mga sekreto niini sa makausa. Inay, Naglihok kini a Struktura sa TIEDED Pyramid sa pagpakita mga panel nga nagbulag sa labing kaayo gikan sa uban.

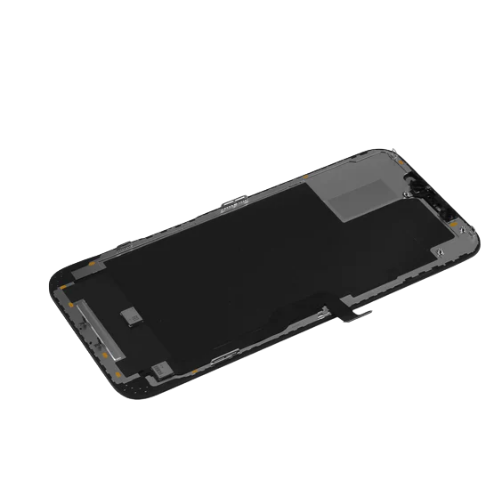

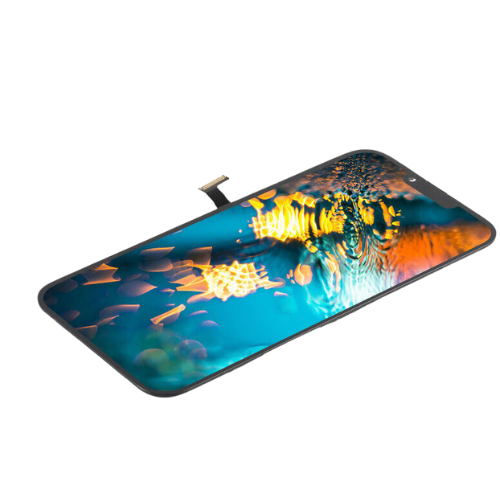

Ang Apex - M Series nga mga Panel

Sa pinakataas naglingkod ang M Serye, ang korona nga hiyas sa produksiyon sa OLED sa Samsung. Kini nga mga panel gireserba nga eksklusibo alang sa kaugalingon nga serye sa Galaxy S ug Galaxy Z sa Samsung, ingon man ang mga iPhone sa Apple.

Nganong exclusivity? Tungod kay kini nga mga panel nagrepresentar sa pinakabag-o ug labing dako sa OLED nga inhenyeriya—bisan kini nga peak nga kahayag nga sobra 2,500 nits, pagkunhod sa konsumo sa kuryente pinaagi sa mga advanced nga materyales, o pagkasibu sa kolor nga makaguba sa rekord.

Ang Samsung kasagaran nalingaw sa usa ka eksklusibo nga panahon diin walay laing brand nga maka-access niini nga mga panel. Gisiguro niini nga ang mga punoan nga punoan sa Galaxy ug iPhone magpadayon sa usa ka tin-aw nga biswal nga bentaha labaw sa mga kakompetensya alang sa labing menos usa ka siklo sa produkto.

Ang Tunga - E Series Panels

Sunod moabut ang E Serye, nga kanunay nimo makit-an sa high-end flagship sa China sama sa mga modelo sa Ultra sa Xiaomi, Mangita si Octo x, o serye sa Vivo X.

Kini nga mga panel maayo gihapon, apan kulang sila sa pipila nga mga pagdalisay sa serye sa M. Tingali ang Ang pag-refresh rate calibration dili ingon maayo, o ang ang kinabuhi sa mga organikong materyales gamay nga labi ka gamay. Ang mga lebel sa kahayag mahimo nga labing ubos, pagsiguro sa Samsung ug Apple magpadayon sa paghambog sa mga katungod.

Kini nga tiering tinuyo. Pinaagi sa pagtanyag og maayo apan dili hingpit nga mga panel sa mga karibal, Ang Samsung naghimo salapi gikan sa paghatag kanila samtang nagpadayon pa Pagpadayon sa labing kaayo nga kard alang sa iyang kaugalingon.

Ang basihan - mga panel sa masa nga merkado

Sa ilawom sa piramide mga ored panel nga gidisenyo alang sa mga mid-range nga aparato. Kini kini nag-una Balanse sa performance sa gasto, kanunay sa yano nga mga arkitektura ug pagkunhod sa komplikado sa produksiyon.

Gihatagan kini sa Samsung sa kadaghanan, dili lamang alang sa kaugalingon nga serye sa Galaxy A apan alang usab sa mga eksternal nga kontrata. Dinhi diin ang scale nagmaneho sa kita, pagsiguro nga ang Samsung nagpadayon sa dominasyon sa daghang mga bahin sa presyo.

Vertical Integration Bentaha

Usa sa pinakadako nga bentaha sa Samsung mao bertikal nga panagsama. Dili sama sa daghang mga kakompetensya, Gikontrol sa Samsung ang duha sangkap (Gipakita ang Samsung) ug ang katapusan nga produkto (Samsung Electronics).

Kolaborasyon sa mga Dibisyon

Ang Samsung Display nagtrabaho sa kamot-sa-kamot sa Samsung Electronics sa ipasibo ang mga panel ilabi na alang sa mga galamiton sa Galaxy. Mga bahin sama sa Ltpo (variable nga refresh rate), ultra-thin foldable bildo, o gipaayo nga PWM dimming makita una sa Samsung nga mga telepono tungod niining suod nga kolaborasyon.

Pagkontrol sa Gasto ug Kalig-on sa Suplay

Pinaagi sa pagpanag-iya sa kadena sa suplay, Samsung mahimo pagpakunhod sa pagsalig sa mga external vendors, i-stabilize ang mga abot sa produksiyon, ug pagpadayon sa mga margin sa ganansya. Kini hinungdanon sa usa ka industriya diin yield rates direktang makaapekto sa presyo.

Gipadali ni R&Os

Gipaambit ni R&Ang mga pamuhunan sa D sa tibuuk nga grupo nagpadali sa kabag-ohan. Ang Samsung Display nagpalambo sa hardware, samtang ang Samsung Electronics nagdesinyo sa software optimization—naghimo og usa ka ang mga kakompetensya sa synergy nanlimbasug sa pagsundog.

Mga Insight sa Estratehiya sa Market

Nagdula ang Samsung a duha ka nawong nga papel sa merkado sa smartphone: usa ka mabangis nga kakompetensya ug usa ka kasaligan nga supplier.

Internal nga Strategy

Sa sulod, Gibaligya sa Samsung ang mga punoan nga aparato niini sa palibot "Ang labing kaayo nga pasundayag sa industriya." Bisan sa mga ad o paglansad sa produkto, Ang kalidad sa screen kanunay nga gipasiugda ingon usa ka talagsaon nga punto sa pagbaligya.

Kini dili lang marketing fluff-kini gisuportahan sa Samsung sa desisyon sa pugngi ang mga panel sa M Series alang sa iyang kaugalingon, pagsiguro nga ang mga punoan nga mga barko niini mas hayag, sa literal ug mahulagwayong paagi.

Eksternal nga Estratehiya

Sa gawas, Ang Samsung mikita og binilyon pinaagi sa pagbaligya sa mga display ngadto sa mga kaatbang. Hinoon, mabinantayon kaayo kini: paghatag kanila og taas nga kalidad nga mga panel, apan dili gayud ang labing maayo.

Kini nga dual nga estratehiya nagtugot sa Samsung sa ganansya gikan sa kalampusan sa mga kakompetensya niini samtang nagmintinar teknikal nga pagkalabaw.

Mga Hagit sa Kakompetensya

Sa dalan, Ang dominasyon sa Samsung wala mapakyas. Ang mga tighimo sa display sa China kusog nga nag-uswag.

BOE (Beijing Oriental Electronics)

Ang BOE nahimong mga ulohan sa Nagsuplay sa mga OLED panel alang sa Apple iPhones. Kini usa ka dako nga pagbalido sa pag-uswag niini. Hinoon, ang pinakadako nga hagit niini nagpabilin scaling nga abot sa high-end nga lebel ug pagpares sa pagkamakanunayon sa Samsung sa dako nga volume nga produksiyon.

TCL CSOT (China Star Optoelectronics Technology)

CSOT, gisuportahan sa TCL, agresibo nga nagtubo, ilabi na sa foldable OLEDs. Ang estratehiya niini mao ang pag-focus sa cost efficiency ug paspas nga pagpalapad sa kapasidad, nagtumong sa pagpaubos sa dominasyon sa Samsung.

Mga babag sa Catch-Up

Pa, dili sayon ang pagbungkag sa lead sa Samsung. Ang paghimo sa OLED naglakip patented nga mga materyales, komplikado nga kagamitan, ug dugay nga kahibalo. Ang mga rate sa ani sa ultra-high nga mga resolusyon ug peak nga kahayag nagpabilin nga usa ka lisud nga nut alang sa mga kakompetensya sa pag-crack.

Epekto sa Global Market

Ang talagsaon nga posisyon sa Samsung ingon pareho supplier ug kakompetensya nagmugna og ripple effects sa tibuok industriya.

- Ang mga Intsik nga tatak kanunay nga makit-an ang ilang kaugalingon usa ka lakang sa likod, bisan unsa pa ka agresibo ang ilang pagpamaligya sa ilang mga flagship.

- Nakabenepisyo ang Apple gikan sa teknolohiya sa Samsung samtang gihatagan usab gahum ang BOE ingon usa ka backup nga supplier-paghimo usa ka delikado nga balanse.

- Ang mga konsumedor sa tibuok kalibutan nagtagad sa nga brand adunay "Samsung-eksklusibo" nga mga panel, paghulma sa mga panglantaw sa kalidad ug kabag-ohan.

Kataposan

Sa katapusan sa adlaw, Ang estratehiya sa pagpakita sa Samsung labaw pa sa usa ka teknolohikal nga roadmap-kini usa ka estratehikong hinagiban. Pinaagi sa pagpugong sa duha sa supply chain ug end-user nga kasinatian, Ang Samsung dili lamang nagsiguro sa mas taas nga ganansya apan naghulma usab sa pangkalibutanon nga natad sa panggubatan sa smartphone.

Ingon nga mga kakompetensya sama sa BOE ug CSOT mosaka sa hagdan, ang pangutana dili kung madakpan ba nila ang Samsung-kini kung unsa ka dugay ang Samsung makapadayon sa gintang nga igo nga lapad nga magpabilin nga dili malalis nga hari sa mga display sa smartphone.

FAQS

1. Ngano nga gitipigan sa Samsung ang labing kaayo nga mga screen alang sa kaugalingon nga mga aparato?

Tungod kay kini nagsiguro nga ang mga flagship sa Galaxy kanunay nga makita, pagpadayon sa ilang premium nga imahe ug pagpangulo sa merkado.

2. Unsa ang kalainan tali sa Samsung M ug E series panels?

Ang mga panel sa serye sa M mao ang top-tier nga adunay mas taas nga kahayag, pagkaepisyente, ug durability, samtang ang E series nga mga panel maayo kaayo apan gamay nga gipaubos alang sa gawas nga mga kliyente.

3. Giunsa pagsulay sa mga Chinese nga brand nga mabuntog ang pagpanguna sa Samsung?

Pinaagi sa pagtrabaho kauban ang BOE, CSOT, ug uban pang mga supplier aron makahimo og kompetisyon nga mga OLED, ug pinaagi sa negosasyon sa Samsung alang sa mga advanced panel.

4. Nagsalig pa ba ang Apple sa Samsung Display?

Oo, Ang Apple nagsalig pag-ayo sa Samsung alang sa taas nga abot, taas nga kalidad nga mga OLED, bisan tuod ang BOE nagsugod sa pag-supply og mas gagmay nga mga bahin.

5. Malabwan ba sa BOE o CSOT ang Samsung sa sunod nga dekada?

Posible kini, pero lisod. Samtang ang mga kompanya sa China nagkuha sa teknolohiya, Naghupot gihapon ang Samsung og mga bentaha sa mga patente, yield rates, ug paghiusa sa kaugalingon nga mga smartphone.