Εισαγωγή

Spain’s smartphone market has undergone major shifts from 2019 να 2025. Once dominated by Samsung and Huawei, it’s now led by Apple, Samsung, and Xiaomi. At the same time, Spain’s mobile repair ecosystem — one of the most mature in Europe — has expanded steadily as consumer demand for affordable repairs grows under EU sustainability policies.

This market research report compiles findings from StatCounter, Kantar, IBISWorld, Eurobarometer, and multiple academic studies to present a full picture of Spain’s mobile and repair markets.

Executive Summary

Between 2019 και 2025, Spain’s smartphone brand landscape transformed dramatically.

- 2019: Samsung led with 28.3%, followed by Huawei (20.7%) and Apple (18.9%).

- 2025: μήλο (27.6%), Samsung (26.8%), and Xiaomi (23.9%) dominate.

Εν τω μεταξύ, ο repair sector has grown with a CAGR of ~3.6%, hosting over 4,000 registered repair businesses. Screen and battery replacements remain the top services, driven by the popularity of OLED displays and higher device prices.

Consumer behavior is shifting — surveys show 77% of Spaniards prefer to repair rather than replace devices, although cost and spare part access remain barriers.

Methodology & Data Sources

This analysis draws from multiple datasets and reports:

- StatCounter for vendor market share (traffic-based)

- Kantar και Counterpoint for unit sales and top models

- IBISWorld for Spain’s repair industry structure

- Academic and EU sources for consumer behavior and “Right to Repair” trends

Differences in methodology are acknowledged — StatCounter reflects active use, while Kantar provides sales data. Combined, they form a reliable overview of Spain’s smartphone ecosystem.

Market Overview (2019–2025)

The Spanish smartphone market mirrors global patterns but with unique regional twists:

- Early in the decade, Huawei και Samsung dominated.

- Οι Η.Π.Α. trade ban on Huawei (2019–2020) caused a rapid loss of share.

- Xiaomi, with affordable and feature-rich phones, filled that vacuum.

- μήλο gained share steadily, boosted by installment financing and trade-in programs popular in Spain.

Brand Market Share Evolution

2019 Snapshot

- Samsung: 28.3%

- Huawei: 20.7%

- μήλο: 18.9%

2025 Snapshot

- μήλο: 27.6%

- Samsung: 26.8%

- Xiaomi: 23.9%

The transition highlights the decline of Huawei και rise of Xiaomi, while Apple consolidated its premium leadership.

Huawei’s Fall and Xiaomi’s Rise

Huawei’s downfall began with U.S. sanctions limiting Google Mobile Services. Με 2021, its share had collapsed across Europe. Xiaomi seized this opportunity, offering value-for-money smartphones with strong specs and reliable MIUI updates — perfect for cost-conscious Spanish buyers.

Apple and Samsung’s Battle for Premium Dominance

Apple maintained a loyal customer base and improved financing plans through carriers like Movistar and Orange. Samsung countered with competitive models like the Galaxy S series και A series, capturing both premium and mid-range users.

Με 2025, both brands are nearly neck-and-neck, splitting the premium segment while Xiaomi owns the budget-to-mid-tier share.

Best-Selling Smartphone Models (2019–2025)

- 2019: Samsung Galaxy A50, A40, and Huawei P30 Lite dominated.

- 2021–2023: iPher 12/13/14 models led premium sales; Xiaomi Redmi Note and Samsung A-series led mid-tier.

- 2024–2025: iPher 15 και 16 series became the top-selling phones, while Xiaomi Redmi Note 13 and Galaxy A55 secured strong rankings.

Apple’s seasonal surges during launch windows show consistent dominance, while Android brands retain steady year-round sales.

The Spanish Mobile Repair Market

Industry Structure

According to IBISWorld, Spain hosts around 4,012 active repair businesses, with small, independent shops dominating the scene. Growth between 2019–2024 averaged 3.6% annually, driven by the affordability and sustainability movement.

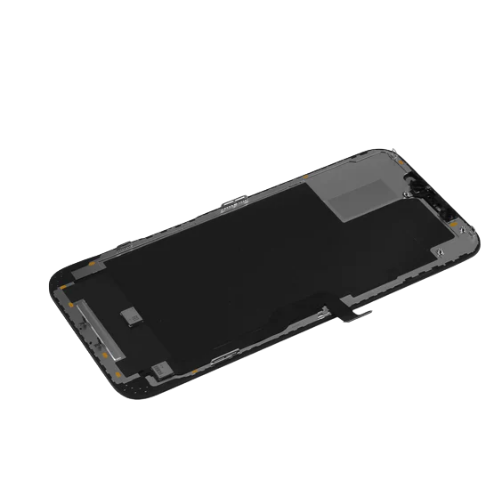

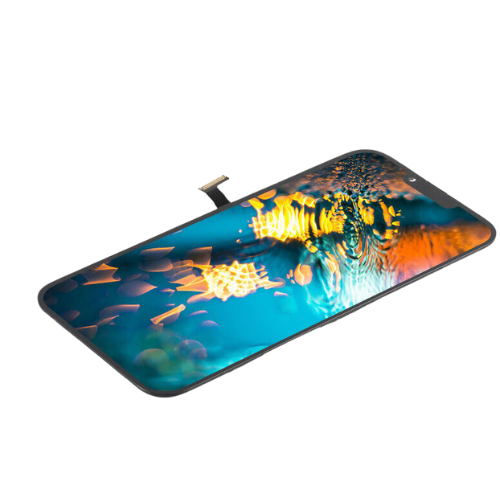

Screen and Battery Replacements

Screen damage is the most frequent repair type, representing 60–70% of all smartphone repair requests. Battery replacements follow closely as devices age beyond two years.

With newer OLED panels replacing older LCDs, repair complexity — and cost — has increased. Many Spanish repair shops stock OEM or high-quality aftermarket parts to maintain competitive pricing.

Τεχνολογία προβολής & Replacement Parts

Με 2024, AMOLED/OLED panels overtook οθόνη υγρού κρυστάλλου as the industry standard. Most new phones in Spain (μήλο, Samsung, Xiaomi) feature OLED displays between 6.1–6.7 inches, typically with FHD+ resolution.

Repair shops therefore prioritize inventory for:

- iPhone 13–16 series screens

- Samsung A & S series OLED assemblies

- Xiaomi Redmi Note series parts

Pricing and Margins

Official service centers charge significantly more for OEM replacements (Π.χ., €250–€400 for OLED panels), while independents offer similar services for €120–€200. Average gross margins for independent repair shops hover around 25–35%, depending on sourcing efficiency.

Consumer Attitudes Toward Repairs

Surveys from the European Parliament και Spanish universities confirm strong repair interest:

- 77% of EU consumers (including Spain) prefer repair over replacement.

- The main barriers are high repair costs, inconvenient access, και limited part availability.

Spain’s local governments have started initiatives such as “repair vouchers” και repair cafés, increasing awareness and participation.

Barriers to Repair

- Price sensitivity: Consumers often compare repair costs with refurbished replacements.

- Προσιτότητα: Many rural areas lack repair infrastructure.

- Information gaps: Lack of transparency about spare parts or warranties discourages repair decisions.

Future Policy & Market Opportunities

The EU’s Right to Repair law, expected to be fully implemented by 2026, will require manufacturers to make spare parts and repair manuals available. This will likely boost repair activity and create new business opportunities for Spanish SMEs.

Στρατηγικές Συστάσεις

For Parts Distributors

- Focus on stocking OLED screen assemblies και μπαταρίες for Apple, Samsung, and Xiaomi.

- Build direct relationships with verified suppliers to maintain quality.

For Repair Shops

- Offer γρήγορα, transparent pricing and promote sustainability benefits.

- Consider partnerships with insurance providers and telecom operators for volume work.

For Manufacturers & Policymakers

- Ensure spare parts and technical documentation are accessible.

- Support consumer awareness campaigns promoting repair over replacement.

Σύναψη

Between 2019 και 2025, Spain’s smartphone and repair markets evolved from a Huawei–Samsung duopoly to a three-way race among Apple, Samsung, and Xiaomi.

The repair sector has matured, propelled by sustainability trends and new EU policies. As OLED panels και longer device lifecycles become the norm, repair businesses have an opportunity to thrive — provided they adapt to changing technology and consumer expectations.

Συχνές ερωτήσεις

1. What are the top smartphone brands in Spain in 2025?

μήλο, Samsung, and Xiaomi dominate, together holding over 75% της αγοράς.

2. Why did Huawei lose market share in Spain?

U.S. sanctions blocked Google services, reducing Huawei’s competitiveness and causing a sharp decline.

3. What are the most common mobile repairs in Spain?

Screen and battery replacements are the most frequent, followed by charging port and water-damage repairs.

4. How will the Right to Repair law affect Spanish consumers?

It will make spare parts and repair manuals more available, lowering costs and improving sustainability.

5. What models should repair shops stock parts for in 2025?

iPhone 13–16 series, Samsung Galaxy A/S series, and Xiaomi Redmi Note series models.