Introduktion

Can glass bend? It sounds impossible—until you meet UTG, or Ultra-Thin Glass. Under tiden, CPI film, a soft and flexible polymer, hides surprising toughness. These two materials are at the heart of a technological duel shaping the future of foldable smartphones.

Since the first foldable phones appeared in 2019, the market has exploded. According to CINNOR Research, över 1.3 million foldable phones were sold in China in the first half of 2022, surpassing all of 2021. The rise of foldable technology marks a new era in mobile innovation, where materials science meets artistry.

Foldable Phones – From Concept to Commercial Reality

When foldables debuted, they seemed like futuristic prototypes. But within four years, they’ve become a serious segment of the premium smartphone market. Issues like fragile screens and visible creases are being solved. Prices, once above ¥20,000, now start at around ¥5,999 in China, bringing the technology closer to the masses.

This growth isn’t just a win for phone brands—it’s a catalyst for a new supply chain revolution in flexible AMOLED displays.

The Race for Differentiation in the High-End Market

I 2022, Apple still dominated the high-end smartphone market—but with no foldable iPhone in sight. That opened the door for Chinese brands to carve their niche.

Huawei, Xiaomi, OPPO, vivo, Ära, and Motorola jumped in, each experimenting with new designs—book-style, clamshell, and even rollable prototypes. Foldables became the new frontier for brand prestige and innovation leadership.

The Heart of the Battle – Cover Material Technology

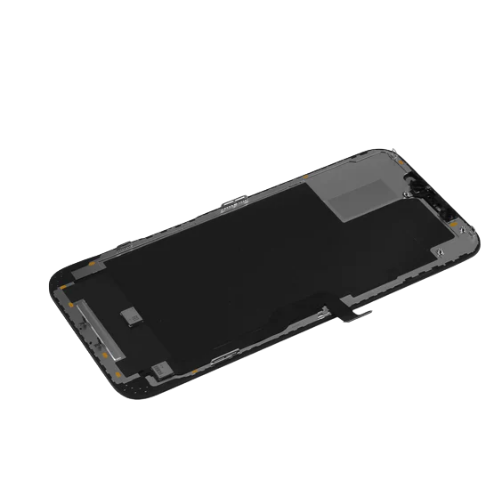

While hinges ensure smooth folding, de cover layer defines how the phone feels and lasts. Two main contenders dominate this space:

- CPI (Colorless Polyimide) – The original flexible film

- UTG (Ultra-Thin Glass) – The bendable glass challenger

Their battle is a microcosm of the broader war between polymer flexibility and glass durability.

CPI (Colorless Polyimide) – The Flexible Polymer Pioneer

CPI was the first to make foldable screens possible. As a transparent high-performance polymer, it’s light, flexibel, and highly foldable.

Dock, CPI has several drawbacks—it ages easily, is softer than glass, and can scratch or yellow over time. Despite this, it was indispensable during the early phase of foldable innovation.

Early Adopters and Use Cases

De Samsung Galaxy Fold (2019) och Huawei Mate X both used CPI cover films. They demonstrated the material’s potential while exposing its weaknesses—surface scratches, glare, and plastic-like touch sensations.

These limitations pushed engineers to find a better balance between softness and strength.

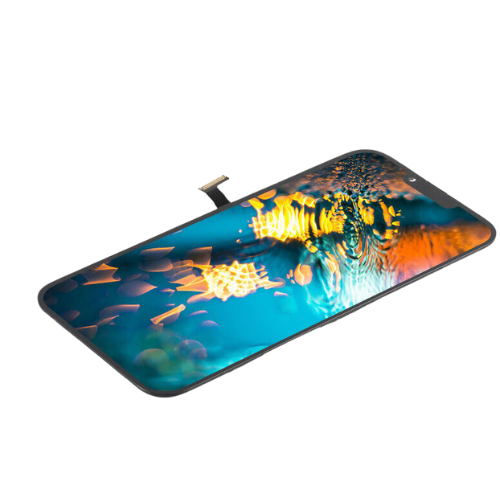

UTG (Ultra-Thin Glass) – The Glass That Bends

Enter UTG: glass so thin it bends like a leaf. When the glass is less than 100 micrometers thick, it becomes flexible without losing its clarity.

UTG offers several advantages:

- Superior transparency and visual quality

- Better resistance to heat and folding marks

- A smoother, glass-like touch experience

But perfection comes at a price. UTG is difficult to produce—its yield rate is low, costs are high, and it’s still prone to shattering under pressure.

Samsung’s Breakthrough

De Galaxy Z Flip (2020) marked a turning point—it was the first mass-produced smartphone using UTG. This milestone pushed the entire industry forward, signaling that glass could be both elegant and elastic.

Consumers noticed: the tactile feel improved dramatically, and UTG instantly became a symbol of premium foldables.

Hybrid Solutions – Combining Strength and Flexibility

Instead of choosing between glass or film, manufacturers began combining both.

Samsungs UTG + CPI hybrid places a thin CPI layer atop the UTG sheet—enhancing durability without sacrificing clarity.

Huawei took a different route, adopting a dual-layer CPI system for the Mate Xs, which increased strength by 80% and improved moisture resistance.

As Schott’s product director He Feng notes, “The future lies in composite structures. Foldable screens will always need a combination of materials—glass plus something else.”

The Supply Chain Landscape

The UTG supply chain is led by Germany’s Schott, which pioneered thin glass production over 30 years ago. Corning (USA) och NEG (Japan) follow closely.

In China, Linsteknik (Bourne Optics), Kaisheng, och Changxin are catching up fast—Bourne’s UTG has passed 500,000 fold tests, 25% above the industry average.

For CPI, key players include Sumitomo och SKC, while Kolon prepares for mass production.

China’s growing involvement is reshaping global competition, driving down costs and boosting innovation speed.

Market Forecast and Future Trends

Experts predict that UTG will dominate future foldable smartphones. TrendBank’s research indicates that by 2025, UTG could reach a ¥20 billion market value, with 80% of foldables adopting glass covers.

CPI, dock, won’t disappear. It may thrive in larger foldable devices—like tablets or laptops—where cost and fold radius requirements differ.

Hybrid UTG + PET designs are expected to define next-generation compact foldables.

The Next Chapter – Beyond Foldable Phones

The future isn’t limited to phones. UTG and CPI are paving the way for rollable TVs, wearable displays, och laptop-tablet hybrids.

With innovations in atomic-layer coatings and self-healing polymers, tomorrow’s materials might offer glass clarity with film flexibility—the best of both worlds.

Slutsats

The duel between UTG and CPI is far from over—but it’s no longer a zero-sum game. Both materials have carved their place in the flexible display ecosystem.

In the coming years, expect them to coexist, merge, och evolve together, weaving the future of foldable technology—one bend at a time.

Vanliga frågor

1. What makes UTG different from traditional glass?

UTG is ultra-thin and flexible, unlike standard glass. It can bend without breaking, making it suitable for foldable screens.

2. Why was CPI used before UTG?

CPI was easier and cheaper to produce during the early phase of foldable phone development, despite its lower durability.

3. Which brands currently use UTG technology?

Samsung, Huawei, OPPO, and several Chinese manufacturers have adopted or are testing UTG in their latest foldables.

4. Is UTG more durable than CPI?

In terms of visual quality and scratch resistance, yes. Dock, CPI remains more flexible and impact-resistant.

5. What’s next for foldable screen materials?

Hybrid materials that combine glass and polymer properties will likely define the next generation of flexible devices.