Introduktion

Have you ever wondered why Samsung’s flagship smartphones always seem to have better displays than their competitors, even those released in the same year? Whether it’s higher brightness, richer colors, or better power efficiency, Samsung often sets the benchmark. The reason lies not just in innovation, but in a carefully orchestrated supply chain strategy managed by Samsung Display, the world’s leading OLED supplier.

Let’s peel back the layers of Samsung’s display strategy and uncover how it builds a pyramid of screen technology that influences not only its own Galaxy lineup but also the smartphones of its biggest rivals.

Samsung Display’s Pyramid Structure

Samsung doesn’t give away all its secrets at once. I stället, it operates a tiered pyramid structure of display panels that separates the best from the rest.

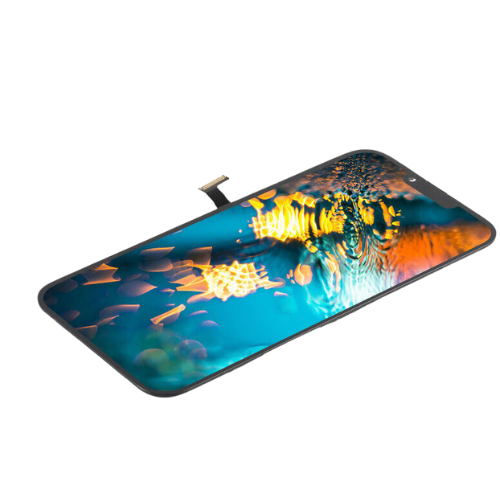

The Apex – M Series Panels

At the very top sits the M Series, the crown jewel of Samsung’s OLED production. These panels are reserved exclusively for Samsung’s own Galaxy S and Galaxy Z series, as well as Apple’s iPhones.

Why the exclusivity? Because these panels represent the latest and greatest in OLED engineering—whether it’s peak brightness exceeding 2,500 nits, reduced power consumption through advanced materials, or record-breaking color accuracy.

Samsung usually enjoys an exclusive period where no other brand can access these panels. This ensures that Galaxy and iPhone flagships maintain a clear visual advantage over competitors for at least one product cycle.

The Middle – E Series Panels

Next comes the E Series, which you’ll often find in high-end Chinese flagships like Xiaomi’s Ultra models, OPPO Find X, or Vivo X series.

These panels are still excellent, but they lack some of the refinements of the M Series. Maybe the refresh rate calibration isn’t as fine-tuned, eller den lifetime of organic materials is slightly shorter. Brightness levels may be capped lower, ensuring Samsung and Apple maintain bragging rights.

This tiering is deliberate. By offering great but not perfect panels to rivals, Samsung makes money from supplying them while still keeping the best cards for itself.

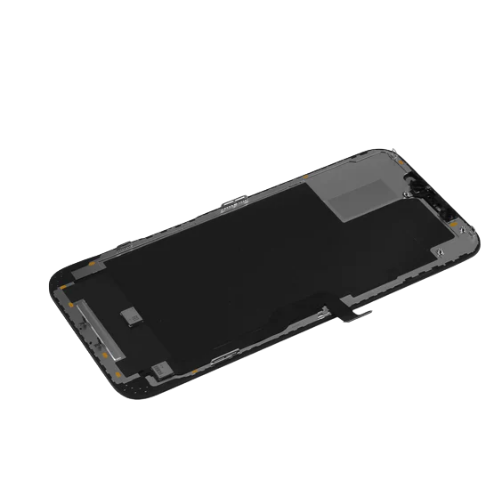

The Base – Mass-Market Panels

At the bottom of the pyramid are OLED panels designed for mid-range devices. These prioritize cost-performance balance, often with simpler architectures and reduced production complexity.

Samsung supplies these in bulk, not only for its own Galaxy A series but also for external contracts. This is where scale drives revenue, ensuring Samsung maintains dominance across multiple price segments.

Vertical Integration Advantage

One of Samsung’s biggest advantages is vertical integration. Unlike many competitors, Samsung controls both the component (Samsung Display) och den end product (Samsung Electronics).

Collaboration Across Divisions

Samsung Display works hand-in-hand with Samsung Electronics to customize panels specifically for Galaxy devices. Funktioner som Ltpo (variable refresh rate), ultra-thin foldable glass, eller improved PWM dimming appear first on Samsung phones because of this close collaboration.

Cost Control and Supply Stability

By owning the supply chain, Samsung can reduce dependency on external vendors, stabilize production yields, and maintain profit margins. This is crucial in an industry where yield rates directly affect pricing.

Accelerated R&D

Shared R&D investments across the group accelerate innovation. Samsung Display develops the hardware, while Samsung Electronics designs the software optimization—creating a synergy competitors struggle to replicate.

Market Strategy Insights

Samsung plays a two-faced role in the smartphone market: a fierce competitor and a trusted supplier.

Internal Strategy

Internally, Samsung markets its flagship devices around “the best display in the industry.” Whether in ads or product launches, screen quality is always emphasized as a unique selling point.

This isn’t just marketing fluff—it’s supported by Samsung’s decision to hold back the M Series panels for itself, ensuring its flagships shine brighter, literally and figuratively.

External Strategy

Externally, Samsung earns billions by selling displays to rivals. Dock, it does so carefully: supplying them with high-quality panels, but never the very best.

This dual strategy allows Samsung to profit from its competitors’ success while maintaining technical superiority.

Competitor Challenges

Naturligtvis, Samsung’s dominance hasn’t gone unchallenged. Chinese display makers are rising fast.

Boe (Beijing orientalisk elektronik)

BOE has made headlines by supplying OLED panels for Apple iPhones. This is a huge validation of its progress. Dock, its biggest challenge remains scaling yields at the high-end level and matching Samsung’s consistency in large-volume production.

TCL CSOT (China Star Optoelectronics Technology)

Csot, backed by TCL, is growing aggressively, especially in foldable OLEDs. Its strategy is to focus on cost efficiency and rapid capacity expansion, aiming to undercut Samsung’s dominance.

Barriers to Catch-Up

Ännu, breaking Samsung’s lead isn’t easy. OLED manufacturing involves patented materials, complex equipment, and long-term know-how. Yield rates at ultra-high resolutions and peak brightness remain a tough nut for competitors to crack.

Global Market Impact

Samsung’s unique position as both supplier and competitor creates ripple effects across the entire industry.

- Chinese brands often find themselves one step behind, no matter how aggressively they market their flagships.

- Apple benefits from Samsung’s tech while also empowering BOE as a backup supplier—creating a delicate balance.

- Consumers worldwide pay attention to which brand has the “Samsung-exclusive” panels, shaping perceptions of quality and innovation.

Slutsats

At the end of the day, Samsung’s display strategy is more than just a technological roadmap—it’s a strategic weapon. By controlling both the supply chain and end-user experience, Samsung not only secures higher profits but also shapes the global smartphone battlefield.

As competitors like BOE and CSOT climb the ladder, the question isn’t whether they’ll catch Samsung—it’s how long Samsung can keep the gap wide enough to remain the undisputed king of smartphone displays.

Vanliga frågor

1. Why does Samsung keep the best screens for its own devices?

Because it ensures Galaxy flagships always stand out, maintaining their premium image and market leadership.

2. What’s the difference between Samsung M and E series panels?

M series panels are top-tier with higher brightness, effektivitet, och hållbarhet, while E series panels are excellent but slightly downgraded for external clients.

3. How do Chinese brands try to overcome Samsung’s lead?

By working with BOE, Csot, and other suppliers to develop competitive OLEDs, and by negotiating with Samsung for advanced panels.

4. Is Apple still dependent on Samsung Display?

Ja, Apple relies heavily on Samsung for high-yield, top-quality OLEDs, although BOE has started supplying smaller portions.

5. Will BOE or CSOT surpass Samsung in the next decade?

It’s possible, but difficult. While Chinese firms are catching up in technology, Samsung still holds advantages in patents, avkastningsnivåer, and integration with its own smartphones.