1. Invoering

1.1 Purpose of the Research

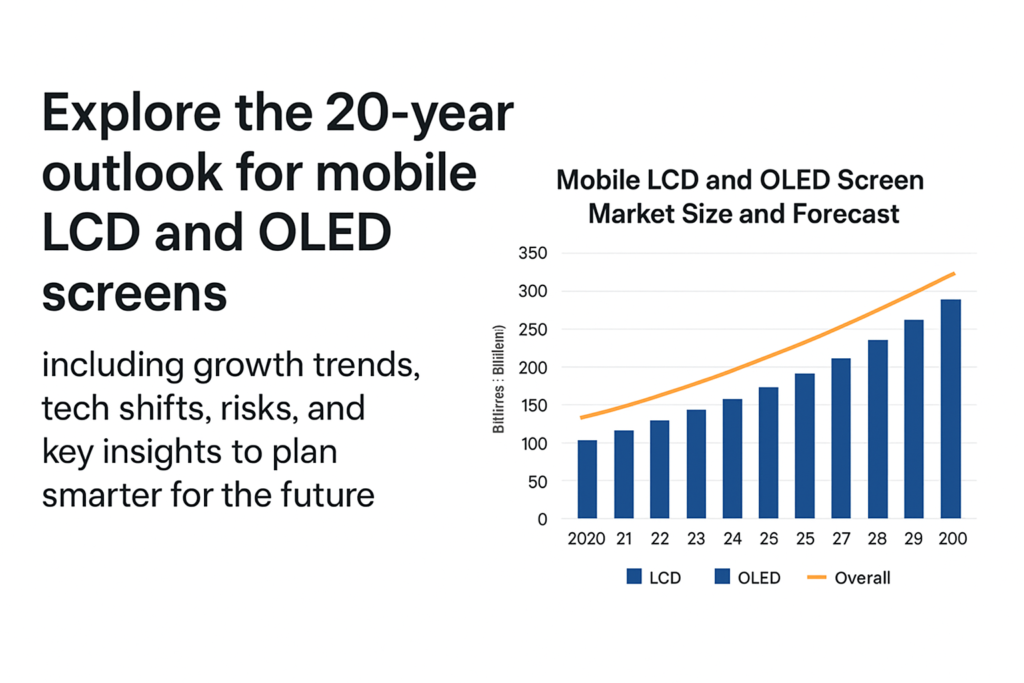

This report aims to analyze and forecast the global mobile phone display panel market — specifically LCD (liquid crystal display) En OLED (organic light-emitting diode) — over the next 20 years (2025–2045). It provides insights into shipment trends, revenue growth, competitive dynamics, technological shifts, and risks, to support strategic decision-making for manufacturers, OEMs, investors, and policymakers.

1.2 Scope: Mobile LCD vs. OLED

We focus on smartphone displays only, excluding other types such as TVs, monitoren, or automotive displays. Our analysis compares rigid and flexible OLED, different LCD variants, and projects long-term market share, technological evolution, and regional dynamics.

1.3 Methodology and Data Sources

Our forecast is based on:

- Historical data and shipment figures from Omdia (bijv., Omdia reports that in 2024, AMOLED shipments reached 784 million units, surpassing TFT-LCD shipments). Omdia+1

- Display revenue trends (bijv., SID Display Week forecast: OLED revenues $46 B in 2024, LCD $83 B). Display Daily+1

- Industry research from Chinese market sources (bijv., Chinese OLED market projections). 中国互联网新闻网

- Market-report projections (MRFR’s smartphone display panel market from 2022 naar 2032). 市场研究未来

- Additional data from corporate announcements (bijv., Universal Display Corp’s comments citing Omdia data). 財報狗

2. Smartphone Display Technology: An Overview

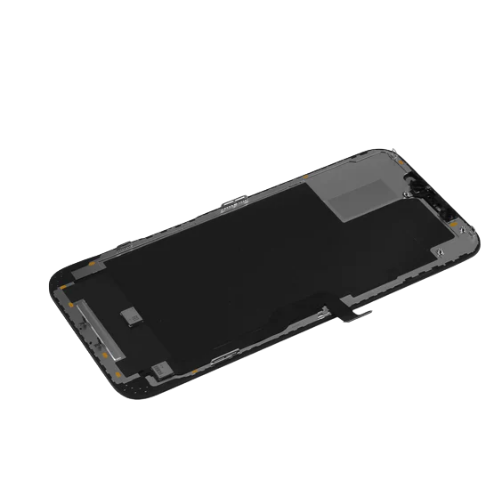

2.1 What Is LCD?

LCD (Vloeibare kristalweergave) is a mature display technology that uses a backlight shining through liquid crystals to create images. There are various types (Tft, IPS, enz.), but they all rely on a separate light source.

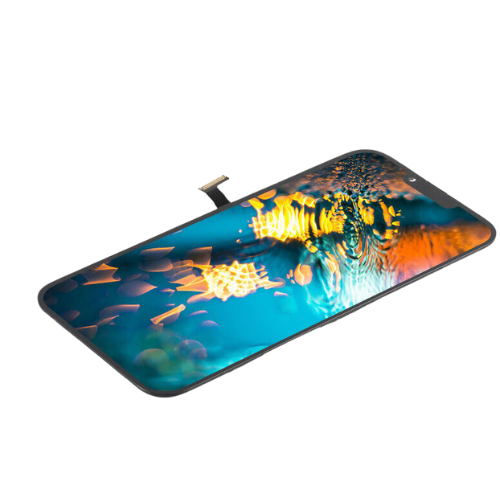

2.2 What Is OLED?

OLED (Organische lichtemitterende diode) panels emit their own light: each pixel is self-luminous. This allows deeper blacks, higher contrast, and potentially more power-efficient designs when parts of the screen are dark.

2.3 Key Differences: Stroom, Flexibiliteit, Kosten

- Stroom: OLED can turn off individual pixels — more power efficient in some cases.

- Flexibiliteit: OLED panels can be made flexible, enabling foldable phones.

- Kosten: Historically, OLED has been more expensive per unit than LCD, especially for flexible or high-end versions.

3. Historical Context and Market Evolution

3.1 Early Era: Dominance of LCD

In the early 2010s, LCD was the dominant technology in smartphones because of its lower cost and mature manufacturing. Most mainstream devices used TFT-LCD or IPS LCD.

3.2 Rise of OLED in Smartphones

Over the past decade, OLED gradually infiltrated high-end smartphones. The advantages of contrast, form factor, and energy consumption (in dark mode) made it attractive. Foldable phones accelerated flexible OLED adoption.

3.3 Key Inflection Points

- Entry of flexible OLED in foldables

- Cost reductions via mass production

- Strategic investments by big panel makers (bijv., BOE, Samsung, LG)

- Transition of major OEMs to OLED for premium lines

4. Current Market Status (2024–2025)

4.1 Shipment Data: OLED vs LCD (Units)

- According to Omdia, in 2024, AMOLED shipments reached 784 million units, terwijl TFT-LCD shipments dropped to 761 million units. Omdia

- This marked the first time OLED shipments surpassed TFT-LCD in smartphones. Omdia

4.2 Revenue Landscape by Technology

- Based on the SID Display Week 2025 forecast, display revenues in 2024 were roughly: OLED: $46 billion, LCD: $83 billion. Display Daily

- According to counterpoint in a translated Chinese analysis, global OLED display revenue reached USD 46 B in 2024. 东方财富

- Omdia projects OLED (AMOLED) revenue to reach $53 B in the full year (future forecast). Mobile World Live

4.3 Regional Dynamics and Key Players

- China is a major force: Chinese OLED makers (BOE, Tianma, Visionox, enz.) are scaling aggressively. Omdia+1

- Korea (Samsung-scherm, LG) continues to play a leading role, especially in flexible OLED.

- According to a Chinese market report, flexible OLED penetration in China is expected to rise sharply; transparent/flexible technologies may also expand. 中国互联网新闻网

5. Drivers for OLED Growth

5.1 Falling Manufacturing Costs

- As OLED fab capacity increases (especially in China), the cost per unit comes down.

- Chinese flexible OLED maker scale and competitive pricing drove more OEMs to shift mid-range phones to OLED. Omdia

5.2 Flexible / Foldable Smartphone Trend

- The rise of foldable phones fuels demand for flexible OLED.

- According to Chinese industry reports, foldable form factors are a major driver of future OLED adoption. 中国互联网新闻网

5.3 Energie-efficiëntie & Display Experience

- OLED’s ability to power off pixels offers energy savings, particularly in dark UI modes.

- Users increasingly demand richer visuals, Hoge verversingspercentages, and flexible form factors.

5.4 Innovation in Materials and Fabs

- New processes like inkjet-printed OLED and cost-efficient deposition are improving yield and cutting costs.

- Gen-8.6 and other advanced fabs are being built to scale up production. Omdia

6. Challenges for OLED Adoption

6.1 Production Cost Pressures

OLED manufacturing (especially flexible) remains more complex and expensive than LCD. Scaling requires capital-intensive fabs.

6.2 Competition from Emerging Technologies

- Micro-LED: Though still emerging, Micro-LED is a potential long-term threat.

- QD-OLED: Combination technologies may compete in premium segments.

6.3 Supply Chain Risks

Raw materials (organic compounds, encapsulation materials) and specialized equipment may bottleneck production.

6.4 Burn-in Risk & Longevity

OLED panels can suffer burn-in under certain conditions, raising concerns about long-term reliability for some users.

7. LCD’s Role in the Future

7.1 Why LCD Remains Relevant

- Lower-cost manufacturing

- High-volume capacity already existing

- Simpler and more stable supply chain

7.2 Low-cost / Budget Smartphone Segment

For entry-level and lower mid-range phones, LCD may remain dominant because of its cost advantage.

7.3 LCD Production Capacity Trends

Some LCD fabs are being repurposed, but many remain active for mobile display production.

7.4 Regionally Differentiated Demand

In markets where cost sensitivity is high (emerging markets), LCD will likely still serve a large portion of demand.

8. Market Size Forecast (2025–2045)

8.1 Base-case Scenario Assumptions

- Continued OLED adoption, especially flexible

- Moderate decline in LCD units but stable for budget segment

- No sudden disruption from Micro-LED before 2035

8.2 OLED Shipment Forecast

- OLED (AMOLED) shipments: growing from ~0.78 B in 2024, to over 1.2–1.4B units annually by the early 2030s (projected estimate based on trend)

- Revenue growth: from ~$46B in 2024 to potentially ~$70B+ in peak years (assuming ASPs stabilize or slightly drop but volume increases)

8.3 LCD Shipment Forecast

- LCD shipments may decline in absolute units — e.g., from 761 M in 2024, gradually to perhaps 400–600 M in later years as OLED fills high/mid segments

- Revenue: decline reflects both lower units and pricing pressure; but still a significant portion of the total mobile display market due to volume in lower tier devices.

8.4 OLED vs LCD Share Over Time

- By 2030, OLED could capture 60–70%+ of the smartphone display market by units (especially as flexible becomes more common)

- By 2040, it’s possible we see OLED being dominant (>70%) unless a new disruption accelerates.

9. Technological Trends & Innovations

9.1 Flexible and Foldable OLED

- Foldable phones will continue to drive flexible OLED demand.

- More OEMs may launch rollable or stretchable devices, increasing flexible panel demand.

9.2 LTPO, Tandem OLED, Inkjet Printing

- LTPO (Low-temperature polycrystalline oxide) backplanes enable variable refresh rates and power savings.

- Tandem OLED stacks layers to extend lifetime and reduce power.

- Inkjet-printed OLED can potentially lower manufacturing costs and increase yield.

9.3 Hybrid Technologies

- QD-OLED (quantum dot + OLED) might target premium markets.

- Micro-LED: while still nascent, medium-term growth (post-2030) could challenge OLED in some segments.

9.4 Sustainability & Energie-efficiëntie

- OLED’s energy savings in dark UIs help for power efficiency.

- Manufacturers may invest more in eco-friendly materials and recycling.

10. Regional Market Forecast

10.1 China

- Strong OLED capacity build-out.

- Massive domestic smartphone production and adoption.

- Flexible OLED is already being scaled by Chinese makers.

10.2 South Korea

- Home to Samsung Display and LG, continuing high-end flexible OLED leadership.

- Likely to remain key in innovation.

10.3 Europe & North America

- Premium device segments.

- Stable demand, but cost sensitivity may slow full OLED penetration in mid-range.

10.4 Emerging Markets (India, Southeast Asia)

- Price-sensitive: LCD may continue strong here.

- But as OLED costs drop, mid-range OLED may become mainstream.

11. Competitive Landscape & Key Players

11.1 Major OLED Panel Makers

- Samsung-scherm: strong in flexible and premium OLED.

- LG-scherm: OLED, flexible, but more limited in small mobile.

- BOE / Visionox / Tianma (China): growing rapidly, cost-competitive.

11.2 LCD Panel Makers & Their Strategy

- Some LCD makers are downsizing; others may pivot to niche or specialty LCD.

- Legacy LCD makers must decide whether to invest in OLED or streamline.

11.3 New Entrants / Disruptive Players

- Emerging Micro-LED manufacturers.

- Startups working on next-gen OLED processes (bijv., inkjet, tandem).

12. Risks and Uncertainties

12.1 Macro-Economic Risks

- Recessions, inflation, supply chain shocks could slow smartphone demand.

- Capital intensity of new fabs is high — risk if demand slows.

12.2 Technological Disruption

- Micro-LED or other display technologies could displace OLED in the long term.

- If cost or yield improvements for Micro-LED accelerate, OLED’s growth could be capped.

12.3 Trade and Geopolitical Risks

- Export restrictions, tariffs, or geopolitical tensions could disrupt panel supply chains.

- Reliance on particular regions for raw materials or investments is risky.

12.4 Supply Chain Bottlenecks

- Shortage of organic material, equipment, or skilled labor could slow capacity scaling.

13. Strategic Recommendations for Stakeholders

13.1 For Manufacturers (Paneel)

- Invest in flexible OLED capacity and next-gen deposition (bijv., inkjet).

- Optimize yield, reduce cost via automation.

- Explore partnerships to hedge risks (bijv., with OEMs, raw material suppliers).

13.2 For Smartphone OEMs

- Gradually shift mid-range models to OLED as costs drop.

- Use flexible OLED for foldables and innovative form factors.

- Negotiate long-term contracts with panel makers to secure capacity.

13.3 For Investors

- Focus on panel makers scaling flexible OLED.

- Watch for emerging Micro-LED plays.

- Assess risks in capital-intensive fab projects.

13.4 For Governments & Policy Makers

- Encourage local OLED capacity via incentives.

- Support R&D in advanced display tech (OLED, Micro-LED).

- Facilitate supply chain resilience (materials, talent).

14. Future Scenarios

14.1 OLED-Dominant Scenario

- OLED becomes >70% of mobile display units by 2040.

- Flexible OLED is widespread; foldables and rollables common.

- LCD becomes niche, mostly in ultra-budget devices.

14.2 Balanced Coexistence Scenario

- OLED takes 60%+ share by 2030, but LCD remains significant (~30–40%) in lower segments.

- LCD fabs remain economically viable due to volume demand.

14.3 Disruption Scenario (Micro-LED / Ander)

- Micro-LED or hybrid tech begins serious adoption in late 2030s.

- OLED growth slows; new tech eats into premium but also mid-range segments.

15. Conclusie

Over the next 20 years, the mobile display market is likely to shift strongly toward OLED, driven by flexible form factors, falling costs, and innovation. Echter, LCD will not disappear overnight — it will continue to play an important role in price-sensitive segments and emerging markets. Manufacturers and OEMs who invest wisely in OLED capacity and next-gen technologies, while managing risks, can position themselves to benefit from this structural transformation. At the same time, stakeholders should watch for disruptive technologies like Micro-LED, which could reshape the display landscape in the long run.

FAQ's

- Will LCD completely disappear by 2045?

Niet noodzakelijkerwijs. While OLED adoption is expected to grow, LCD may persist in low-cost and entry-level smartphone segments, especially in cost-sensitive regions. - What is driving the rapid rise of OLED?

Key drivers include cost reductions in OLED manufacturing, the popularity of foldable phones, and the superior display qualities (contrast, flexibility) OLED offers. - When might Micro-LED start to seriously compete with OLED in smartphones?

Micro-LED may begin to challenge OLED in the late 2030s to early 2040s, depending on cost, yield, and mass production scalability. - Are there major risks for OLED manufacturers?

Yes — risks include high capital expenditure, supply chain constraints, potential technological disruption, and competition from newer display technologies. - Which regions will lead OLED adoption?

China and South Korea are likely to lead in both production and adoption due to strong panel makers. Emerging markets may follow as OLED costs drop and flexible / mid-range OLED becomes more affordable.